Succession strategy for law firms – what are my options?

Guest article written by Patricia Kinahan at Hazlewoods

Succession is one of the underlying biggest challenges for law firms, no matter your size.

The perception is that succession planning appears to be easier for the larger firms, but getting the right talent in the right place at the right time is what everyone struggles with at times. This is often why mergers and acquisitions activity is becoming such a talking point, as it could be the perfect solution to a difficult challenge or an opportunity for growth, depending on whether you are selling or buying.

What are my Choices?

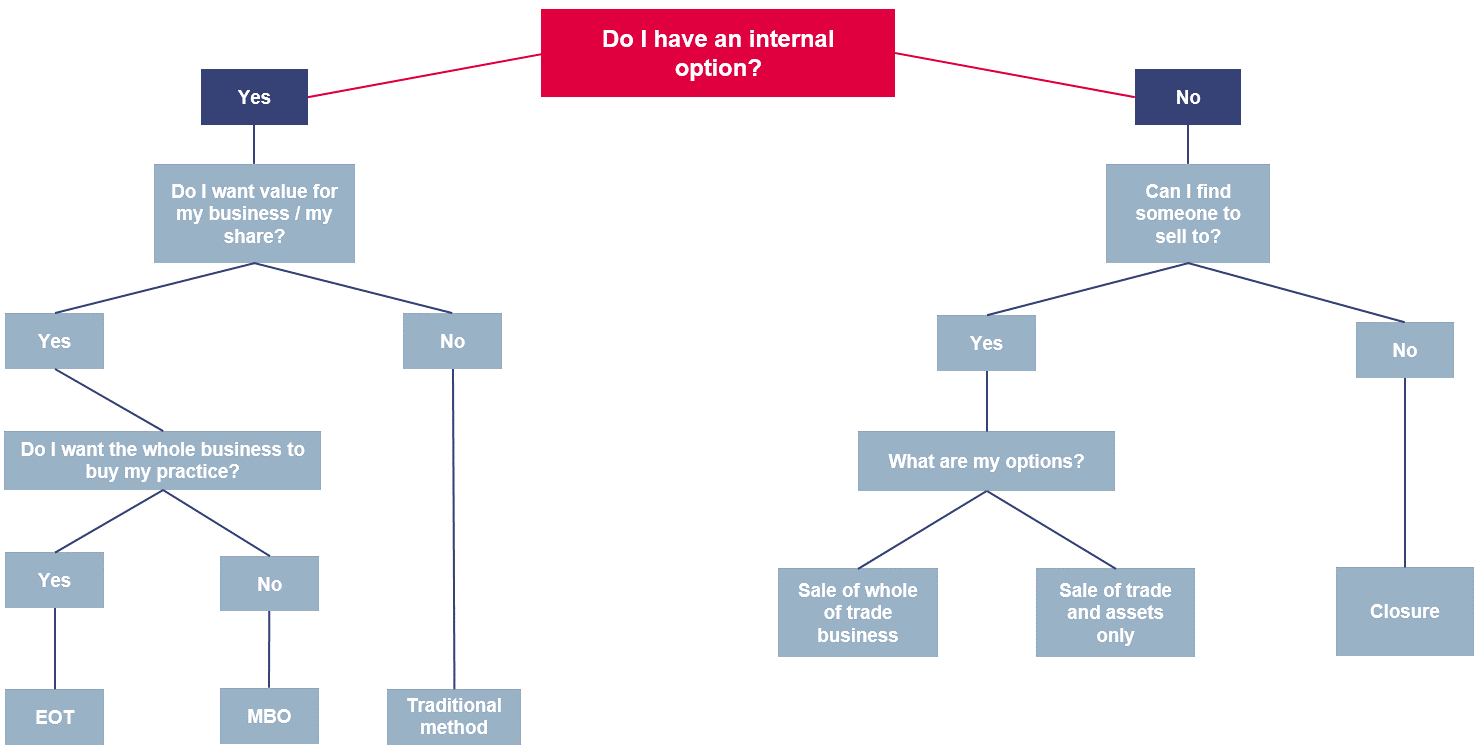

From the outset, everyone has a choice, so it is only a matter of how palatable the choices are. The flow diagram below shows what your options are. It starts with one simple question - do I have an internal option? - as this is the question that gives you the most choices. If there are no internal options, then you are forced to go externally or close.

An internal option may give you an immediate perception that it is going to be far easier. However, this really depends on whether you are looking for value. It is important to define value which, in most internal cases, would be an amount over and above the accumulation of capital and undrawn profits in the business, best known as goodwill.

Traditionally, the legal profession very rarely talked about goodwill, let alone actually received it - a partner in a partnership was a custodian for the business, and hopefully during their working life received a good return for that and left the business in a better shape than when they came to it. With the opening up of the legal sector to outside investors, and increased competition, the concept of goodwill is now used more and more when transferring the business from one generation to another. However, it does not always actually result in a payment for exiting partners.

When looking at internal options, it is important to remember that this is an internal market and not an external market. Headline-grabbing numbers of values of businesses being bought and sold, although interesting, cannot fully drive how an internal market would work. The ultimate success of a succession plan has to be the ability for the ongoing practice to continue, ensuring it is affordable for the new people coming in whilst, simultaneously, ensuring that retiring owners receive a fair reflection, albeit a reduced amount in comparison to what is in the marketplace at that time.

All too often the conversations on succession focus on valuations and what an individual is worth, but a well-thought-out succession plan does not just revolve around paying out an amount of money to that individual, but also ensuring that their workflow continues. The measure of a well executed succession plan is when the business carries on as if that person was never there! This may sound harsh but, in reality, it should be what all owners are aiming for.

How do I treat value?

If conversations have progressed to the point where an additional sum of money is to be paid to a retiring individual, the next step is to consider how that should be treated. Naturally, a retiring individual will want a capital payment as that currently has a better tax rate payable on it. However, the remaining owners would prefer to make a payment that allows them to get tax relief straightaway. Trying to establish how the payment should be classified can cause issues but, as the fundamental point is that the business must continue, it should be affordable for the remaining partners whilst, at the same time, having some reflection on the impact of the retiring individual. There are many ways to structure a retirement payment and advice should be taken very early on if this is to be acceptable to all parties.

Management buy-out (MBO)

MBOs are often seen outside of the legal world, where a senior management team buys out the owners and then carries on the business. The concept can work within legal firms, as this would consist of a collection of individuals (be it owners or new people coming in) who do not necessarily need to be solicitors, providing the structure is that of an alternative business structure (ABS). Conceptually, an MBO can be done in a traditional partnership, a limited liability partnership, or as a company. It can often trigger the conversion to a limited company status, especially where payments in goodwill are being paid and treated as capital in order for the new owners to get some form of tax relief straightaway.

Whether the transaction is treated as a formal MBO is not necessarily relevant, as the underlying concern in any structuring of a transaction is affordability. Like many MBOs outside of the legal profession, before really seeing any increase in return themselves, the senior management team will spend a considerable amount of time post-deal paying either the debt that has been created on buying out the owners, or paying direct to the owners over an agreed period of time. The hopes with an MBO is that the subsequent owners will then sell out to another third party. It is always important to consider what the ultimate exit would be and whether this would work, bearing in mind the legal market as it is at the moment, and the future potential for more consolidation.

Are there any alternatives?

Internally, yes. An alternative option to an MBO is an employee ownership trust (EOT). The popularity of this type of arrangement continues to grow, but not necessarily with a complete understanding of how this could work. The whole concept of an EOT is worthy of a separate article as, although on the face of it, it appears to deal with all the issues of succession planning without a thorough understanding of how it works and what the business needs to be focussed on, it is not necessarily the answer to everyone's prayers when looking at exiting their business.

What are my alternative options if I cannot sell internally?

If the internal route is not available, the two options are to either close the practice or sell to a third party.

For most professionals, closure is the one to be avoided as, not only does it trigger run-off insurance and all of the issues that the profession is currently experiencing beyond the 6 year traditional coverage, but also the cost of redundancy, closure of offices, file storage and more. It is not an option to be undertaken lightly but, in certain circumstances, you are forced to do so as a result of not getting professional indemnity renewal.

Of course, closure cannot be avoided by everyone, but a business should be able to avoid this if succession planning becomes a big priority within the overall strategic plans for the business long term.

How easy is it to sell to a third party?

The external option is often seen as more complicated than the internal option, as there is less control over the process. In some cases, it can be extremely easy if all parties are clear about their intentions, there is good communication about how it would work and some of the thornier issues are resolved early on in negotiations. For others, selling to a third party is extremely difficult depending on how it is structured and the on-going relationship between both parties.

In so many cases, the seller will often stay with the business for a while after the sale to help with the handover. For this reason, it is important to start a business relationship on the right foot and ensure negotiations do not become bitter, as this does not bode well for working together in the future.

Will I get value for my business?

Value means different things to different people. Naturally, value is assumed to be goodwill as defined already in this article, but for others it could be a guaranteed level of income for a period of time, the fact they have secured a successor practice (detailed advice is required on this as the rules are extremely complicated), or the opportunity to work in a bigger organisation for the greater good and, therefore, increase in value and income over a longer period of time.

Understanding what you perceive as value and what you want, and being realistic about this, are the fundamental points that a seller needs to sort out with their advisers before negotiations go too far, as it helps crystallise potential issues which could destroy deals right at the last moment.

Headlines of the latest acquisitions, news of new entrants into the market and continuous updates of performance of listed law firms do give the perception that there is potentially more value in law firms than there was before. However, true value only comes from understanding what your unique selling points are and what benefit your business has to an acquirer. Understand that and you are able to develop an opportunity for yourself to get some value over and above your investment in your firm.

Conclusion

There will always be an option for law firms in terms of how to deal with their practice once they have made a decision that they no longer want to trade independently. The options are dependent on how well you plan for your succession. Succession planning starts the moment you become an owner and not the moment you decide to sell. Often at that point it is too late for you to have the opportunity to make the best choices and maximise value.

Value as a concept has many different interpretations. Understanding what value means to you and what your business has that others are looking for can create something over and above just merely becoming a successor practice. Thinking outside the box is key to any negotiations, as this will ensure you get the best value for your business. Additionally, taking advice early on will avoid a deal falling over, save you both time and money and set you up for a smoother process.

Howden Commentary

A number of law firm owners are currently contemplating their exit strategy from the profession. For some, the cost of professional indemnity insurance, the increasing burden of regulation and reflection in the wake of the pandemic are factors that have focused attention on the issue. Others are simply approaching retirement and looking for options. For many solicitors this is unchartered territory and it is important to consider the range of options available and the pros and cons of each. The attached article from Hazlewoods is a good starting point and provides a very helpful overview. But, the advice is not just for those looking to exit the profession in the short term. The article highlights the importance of early planning and is relevant to all those who are currently owners of a law firm – or contemplating ownership.

As noted in the article, the professional indemnity issues that arise from the successor practice rules for law firms can be complex and we would always recommend that this issue is at the top of the agenda when any you are considering any options. At Howden we are regularly involved in assisting our clients with this and you might also be interested to review our article on this issue available here.

Jenny Screech LLB (Hons)

Legal Professional Consultant, Professional Indemnity, Howden

| Patricia KinahanPartner, Hazlewoods +44 (0)124 223 7661 |

This article has been written by Hazelwoods LLP and the opinions and views stated in this article are those of Hazelwoods LLP and not Howden Insurance Brokers Limited (“Howden”). Howden is an insurance broker and is not authorised or regulated to advise on options for succession strategy. Howden shall not (i) owe or accept any duty, responsibility or liability to you or any other person; and (ii) be liable in respect of any loss, damage or expense caused by your or any other party’s reliance on this article.