Surety solutions

What is Surety?

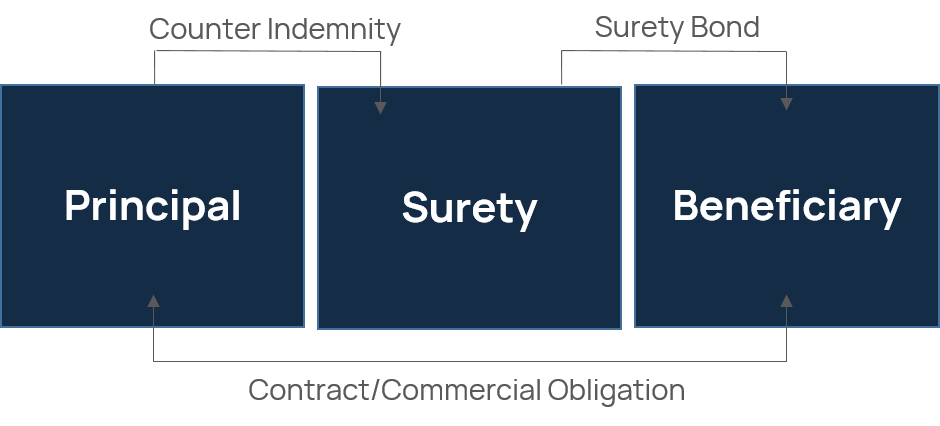

Surety is an obligation by a financial institution (which for our purposes is an insurance company) to guarantee the contractual or commercial obligations of one party, the Principal, to another, the Beneficiary.

Surety bonds can be required under the terms of a contract, or in accordance with statutory or licensing requirements, to secure the performance of the Principal in its commercial or contractual obligations to the Beneficiary.

As illustrated below, a surety bond is a tri-partite agreement issued by an insurer, the Surety, providing monetary compensation to the Beneficiary in the event that the Principal fails to perform its contractual or commercial obligations.

A counter-indemnity is taken from the Principal (and potentially its parent company) allowing the Surety to seek reimbursement in the event the Surety has to pay a claim under the surety bond.

Other service benefits:

- Pricing: consistently delivering competitive terms.

- Market influence: as a leading income generator to the surety insurers we have excellent buying power.

- Bespoke solutions: surety solutions for challenging, innovative and complex transactions.

- Global & local solutions: facilities on a local, regional or global basis.

- Delivery capacity: access to all major providers ensures all capacity options are fully explored.

- Industry expertise: expertise across multiple industry sectors.

- Syndication: organisation of multiple surety capacity to meet large surety bond requirements.

- Document analysis: market leading surety bond review capabilities including the analysis of contract.

- Facility management: full service administration of all day to day surety bond needs and arrangement of competitive surety bond facilities.

Types of Surety bonds

Surety is traditionally divided into two categories

| Contract | Commercial |

|---|---|

|

|

Surety bonds are widely used and are a critical financial tool in many industries:

|

|

Why are insurer issued surety bonds superior to bank surety?

Bonds issued by a bank diminish available headroom underlines of credit and can limit opportunities for growth.

Insurers generally issue surety bonds on an unsecured basis, being provided on the assessment of a company's financial strength and proven track record.

The issuance of surety bonds by an insurer does not impact working capital or bank borrowing facilities, and therefore can provide a useful boost to a company's liquidity.

Meet the team

James

James Souter

James Souter

Managing Director | Head of Surety

James has largely focused on working with large international, Top 250 E&C firms, who previously solely relied upon the banking market to support their guarantee obligations. James has structured solutions for these companies via bank fronting and syndication – most notably with Petrofac, Tecnicas and Mainstream over the past twelve months where he has been involved in arranging over $1 billion worth of capacity.

Warren

Warren Withfield

Warren Withfield

Executive Director | Head of Syndications

Warren Withfield is a Loan Market specialist with over 20 years’ experience in Corporate and Investment Banking. He previously worked in Trade Finance for Investec and Corporate coverage for Commerzbank before joining MUFG where he spent the past 17 years in their Loan Syndications Origination team within MUFG Securities. Warren has recently joined Howden CAP to establish a dedicated Global Syndication desk supporting corporate clients, banks and sovereigns with bank-surety syndication transactions.

Patrick

Patrick Shields

Patrick Shields

Executive Director | Head of Bank Fronting

Patrick is a senior FIG and investment banker with over 30 years’ experience across capital markets and insurance banking. Joining Howden after 8 years at ANZ, Patrick supports in the creation of a dedicated bank fronting desk in order to support clients’ bank guarantee and SBLC requirements globally, as well as assisting partner sureties and partner brokers.

Chris

Chris Coomans

Chris Coomans

Executive Director | Head of Natural Resources Desk

Chris leads the dedicated Natural Resources Desk for Howden Surety which was created in order to support natural resources’ clients bank guarantee and SBLC requirements globally. For the last 14 years Chris has covered ANZ’s natural resources clients – his last role was as Head of REI Europe.

Chris is a senior corporate banker with over 30 years’ experience covering clients in Europe, America and Australia. He qualified as a chartered accountant in 1998, has a Masters degree in Economics and prior to ANZ worked at PwC (corporate advisory and audit) and started his professional career as an officer in the Royal Australian Air Force.

Matthew

Matthew Mayne

Matthew Mayne

Executive Director | In House Solicitor

Matthew is an In-House Solicitor and Executive Director sitting within the Surety team in London. Matthew is involved in all aspects of the Surety business and in particular structuring transactions and reviewing and analysing counter-indemnities, bonded contracts and guarantee wordings. Before joining Howden, Matthew worked in private practice as a corporate and commercial solicitor at Maxwell Winward (now Mills & Reeve LLP) and Trowers & Hamlins.

Tom

Tom Parrott

Tom Parrott

Executive Director | Head of UK and Ireland

With over 8 years’ experience in the surety market, Tom has significant experience across domestic and international guarantee requirements, both on a direct and syndicated basis. Tom supports many multi-nationals and FTSE 250 companies with their guarantee requirements both in the UK and globally, including the US.

Kevin

Kevin Barrett

Kevin Barrett

Divisional Director | Head of Africa and Emerging Markets

Kevin has 27 years of investment banking experience having structured credit solutions for multi-nationals and syndicated risk amongst a diverse range of institutions. Kevin utilises his holistic understanding of credit and insurance markets to deliver the most optimal terms for clients.

Marc

Marc Underwood

Marc Underwood

Divisional Director | Trade Finance Lead (Bank Guarantees and SBLCs)

Marc is a trade finance specialist with over 10 years’ experience in corporate banking with Barclays and NatWest. Prior to joining Howden, Marc applied his trade finance expertise in a corporate environment establishing Lightsource bp’s global trade finance function. In his current role, Marc works with clients globally to structure and execute guarantee and SBLC facilities working with both banks and sureties.

Vanessa

Vanessa Moraes

Vanessa Moraes

Divisional Director

Vanessa is Divisional Director for International Surety, focusing on Bank Fronting & Syndication solutions. She is specialised in banking and financing, with strong experience in ECM, DCM and cross-border M&A transactions, as well as LMA syndicated facilities, having worked for financial institutions and multinational corporations across different jurisdictions.

Cerys

Cerys Traynor

Cerys Traynor

Divisional Director | Head of Business Development

Cerys joined the Howden Surety team in 2016 and is responsible for driving the new business initiatives and client development of the Surety team both in the UK and globally. Cerys has over 10 years’ experience in the Surety industry and over 25 years’ experience of business development in a variety of industry sectors from commercial real estate and construction to IT.

James

James Royal

James Royal

Associate Director | Head of Mining Desk

James is a Mining Engineer from Australia and has seven years of experience in underground mining operations. James has a strong foundation in the mining industry. While studying at the University of Wollongong and then completing the distinguished BHP graduate programme and substantive leadership roles thereafter, James worked in all facets of some of the most technically challenging and successful operations in the southern coalfields of New South Wales, Australia. In order to diversify his life experience while he was flexibly able to, James moved to the UK and added to his operational and leadership experience with senior management roles in the ever challenging UK rail industry. James has now returned to his mining roots by joining Howden as the Head of Mining Desk and is the operational expertise in the team.

Danielle

Danielle Upton

Danielle Upton

Associate Director

Danielle joined Howden in May 2022 from QBE, where she spent just under 8 years in the surety team, starting as an underwriting assistant in 2014, and departing in 2022 as a senior underwriter. Danielle has significant experience in bonding UK construction clients, as well as more non-standard transactions and schemes.

Abigail

Abigail Daly

Abigail Daly

Associate Director

Abigail is a senior broker within the Surety team at Howden, working with UK & Ireland clients from SME’s to multi-nationals to support their bonding requirements. Abigail is responsible for the management of client’s day to day surety needs which includes establishing and managing facilities, reviewing contract wordings, obtaining competitive terms and finding the best solutions for their transactions.

Laura Maria

Laura Maria Diaz Ramirez

Laura Maria Diaz Ramirez

Senior Account Executive

Teresa

Teresa Baena Salado

Teresa Baena Salado

Senior Account Executive

Teresa Baena is a qualified lawyer in Spain, with experience in banking and law firms. Teresa's role in the Surety team is to be the link between the Surety team in Iberia and London, as well as facilitating the legal review of Spanish companies. Teresa also coordinates the Spanish market, so Teresa's role includes looking for new business opportunities in the Spanish market.

Sarah

Sarah Rainbird

Sarah Rainbird

Senior Account Executive

Charles

Charles Treacher

Charles Treacher

Senior Broker

Charles joined Howden at the end of 2021 as one of three graduate hires for the team. He has an educational background in Law and attended the University of Bristol. Since joining, he has worked primarily in the international team, helping to support our clients with their global guarantee needs. In particular, he has focused on structuring bank-fronted solutions, as well helping to grow our presence in Africa.

Sam

Sam Farman

Sam Farman

Senior Broker

Sam has been a part of the surety team for one year, and has been involved in a number of our large structured transactions for our international clients. Sam has gained experience in producing credit memos, drafting and reviewing bond wordings and facility agreements, as well as building strong relationships with the wider surety markets.

Adam

Adam Buckley

Adam Buckley

Broker

Fahmida

Fahmida Miah

Fahmida Miah

Broker

Aimee

Aimee Ellis

Aimee Ellis

Junior Broker

Aimee joined the team in January 2024 having completed a law degree at the University of Exeter. She is working to support the international requirements of our surety clients.

Eason

Eason Reed

Eason Reed

Broker Support

Eason joined the Surety team in October 2022 and provides support both on the broking and operational side of the business. Since joining, he has worked primarily in the UK & Ireland team, and is responsible for the reviewing of bond wordings, maintaining facilities to ensure our clients are most efficiently utilising their facilities, exposure management, and to facilitate bookings to help transactions close smoothly.