Howden's new crypto asset regulation wording

Bespoke risk transfer programmes helping you continue innovating

Blockchain and digital assets are umbrella terms that encompass a wide range of firms, projects and protocols, spanning from DEX/CEX, wallet providers, and custodians to staking platforms, DAOs and blockchain/web3 tech companies.

The digital assets and cryptocurrency space is riddled with complexity and hidden risks, but that shouldn’t hinder your ability to innovate and trade to your full potential. Partnering with a specialist insurance broker like us can give you the expertise and experience within this sector that can help you mitigate the associated risks and allow you to prosper.

Why choose Howden?

At Howden, we have the industry knowledge to understand the intricacies of the structures and professional services provided in this sector. This is combined with our long-standing market relationships which enables us to facilitate the placement of bespoke risk management programmes to help meet your unique exposures.

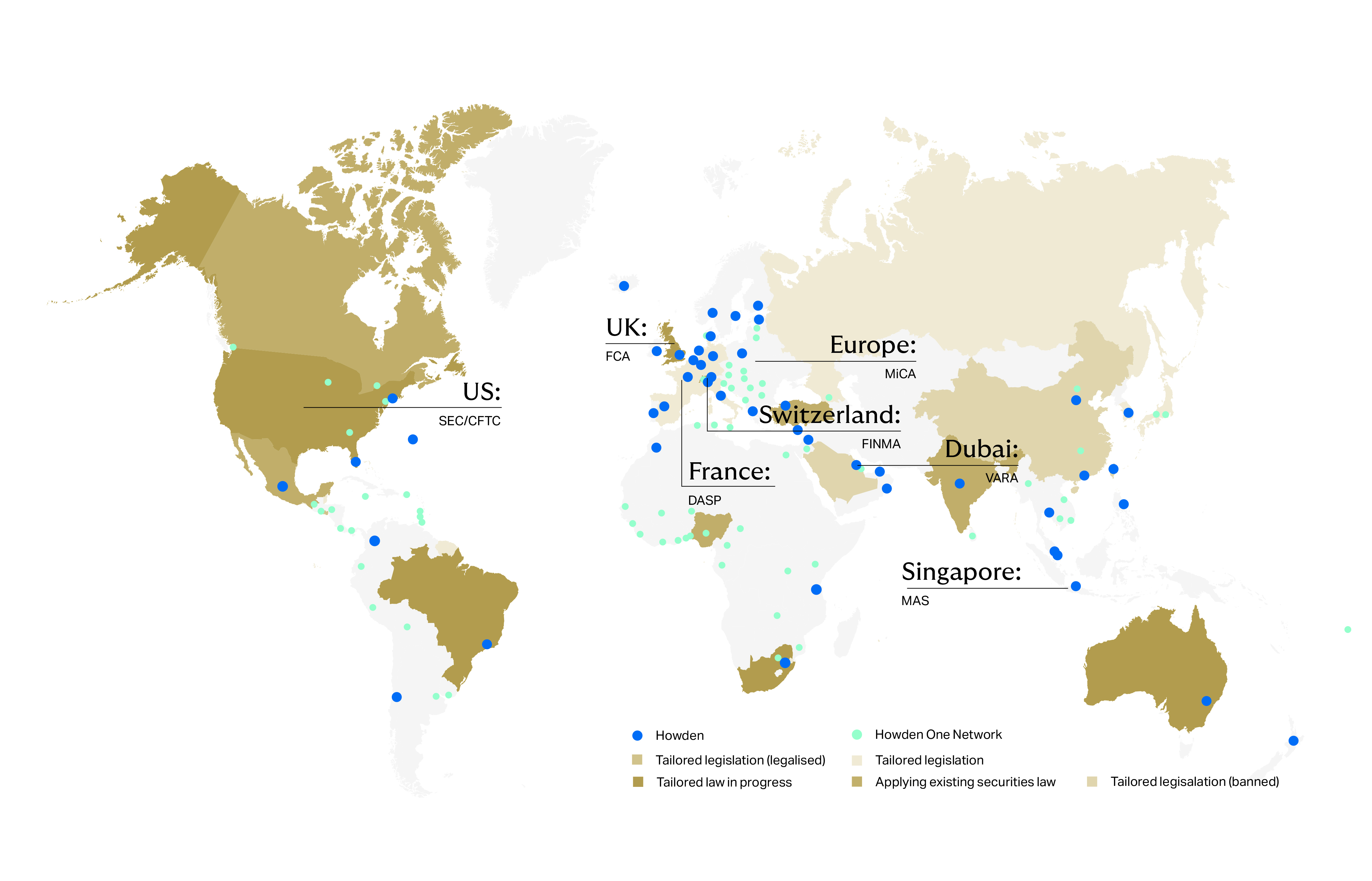

As a group, we have close relationships with specialist underwriters in the digital asset sector that we can leverage on your behalf. We have specialist digital asset practices not only in the United Kingdom (one of Howden’s headquarters), but also in Singapore, Israel, Dubai, Brazil, France, Spain and more which uniquely positions us as the digital asset ecosystem adopts and adapts to the new regulatory changes (see map below).

7+ year's experience

Our team has been operating in this sector since it started and has led more than 60 insurance placements on behalf of a wide range of businesses globally.

Dedicated and specialist team

Specifically focussed on digital assets and blockchain insurance solutions, the Digital Assets team sits with and is supported by Howden’s Financial Lines Group, the second largest financial lines practice in the UK market.

Holistic claims approach

- Exclusive Howden wordings manuscripted and tailored to you.

- Constantly pushing the boundaries of cover and feeding in previous claims experience and data.

- Silent reviews of existing programs, enabling you to benchmark your policies.

Multi-jurisdiction regulatory insight

Advice on legal and regulatory developments, claims trends and market conditions.

First-class service

Howden is the 5th largest employee-owned business in the UK, and because our people are personally invested, they are intent on delivering the best possible results for their clients.

Global market relationships

Headquartered in the UK, we also have specialist digital assets practices across the globe, and as a group have close relationships with the specialist underwriters in the sector that we can leverage on your behalf.

Key insurance solutions we can offer you

- D&O insurance

- Cyber and Tech E&O insurance

- Crime insurance

- Digital asset vault insurance

- PI insurance

- MiCA

- Slashing insurance

- Smart contract failure insurance

- Property insurance

Directors and Officers (D&O) insurance is a type of operational insurance that provides financial protection for the personal assets of company directors, officers, and sometimes employees against claims arising from allegations of wrongful acts as a result of the decisions and actions they make within their management capacity in the business.

Coverage examples

- Legal protection for leadership: Cryptocurrency firms operate in a dynamic and rapidly evolving environment, which can involve complex regulatory, technological, and financial challenges. D&O insurance provides protection for the personal assets of directors and officers in the event they are personally named in a lawsuit, helping attract and retain qualified individuals for leadership positions.

- Regulatory compliance: Given the evolving regulatory landscape surrounding cryptocurrencies, company executives may face legal actions or regulatory investigations related to compliance issues. D&O insurance can help cover legal defence costs and potential fines or penalties resulting from regulatory actions.

- Meet investor requirements: Capital raising rounds can bring additional pressure from investors who may hold the business’s leadership accountable for decisions made which have resulted in negative financial performance. D&O insurance can provide assurance to investors that the leadership team is financially protected, potentially attracting more investment.

- Employee allegations: Employees may bring legal actions against directors or officers within a business for issues such as workplace discrimination, harassment, or wrongful termination. D&O insurance can help cover legal costs associated with defending against such claims.

To find out more, see our D&O page

Cyber liability insurance is a type of operational insurance coverage that helps protect businesses from the financial losses and liabilities associated with cyber-related risks and events. Cyber insurance is designed to address the growing threat of cyberattacks, data breaches, and other cyber incidents.

A cyber policy would not cover theft of private keys - see Crime or Digital Asset Vault insurance tab

Tech E&O

For a company involved in the cryptocurrency or blockchain sector a key consideration could be technology (tech) errors & omissions (E&O). Companies tend to rely heavily on technology, coding and AI, an error in your software could result in financial losses to a third party (client) arising out of your negligence or professional error.

Tech E&O transfers the risk of exposure for technology related issues off the company’s balance sheet.

Commercial crime insurance, also known as crime insurance or fidelity insurance, is a type of operational insurance coverage that protects businesses from financial losses resulting from various internal/external fraud incidents, such as theft, fraud, embezzlement, forgery, and employee dishonesty.

Coverage examples

- Employee dishonesty: As a digital asset exposed firm that handles sensitive financial transactions, employee dishonesty can pose a significant risk. Commercial crime insurance can provide coverage in case employees engage in fraudulent activities, such as embezzlement or theft of funds, fiat or crypto.

- Computer fraud: The digital assets industry is susceptible to cyber crime threats, including hacking, phishing, and other forms of online fraud. Commercial crime insurance may cover losses resulting from unauthorised access to computer systems, electronic theft, or social engineering attacks.

- Social engineering fraud: A cyber incident can have reputational consequences. Cyber insurance may cover the costs of hiring public relations experts and crisis management teams to help mitigate damage to the firm's reputation.

- Regulatory and legal costs: If a firm experiences a cyber incident that leads to regulatory fines or legal actions, cyber insurance can help cover the costs of legal defense and regulatory penalties.

For more information, see our crime insurance page

The digital asset vault insurance solution provides coverage for loss of digital assets from internal / external theft, damage, or destruction of private keys, which are stored in physical vaults. This sector of the insurance market, known as the specie market, has been providing solutions for decades, with focus on coverage for rare metals, or valuable items stored in vaults. Therefore, with the rise of digital assets and the continued importance of security, the market has naturally evolved to provide more than GBP1bn capacity to protect these digital assets that operate in cold/warm environments, however, are physically stored in deep cold physical vaults, or in transit.

Benefits of coverage

- Named perils: Coverage is provided for the loss, damage, or destruction of private keys as a result of perils such as fire, flood, windstorm, earthquake and other natural perils.

- Internal fraud: Coverage is provided for the loss, damage, or destruction of private keys due to deliberate and/or dishonest acts of the Insured’s employees operating in the role of a designated custodian.

- External fraud: Coverage for losses arising out of the copying and/or theft of private keys by third parties physically present at the location(s) where the hardware is utilised by the insured in the generation, storage and retrieval of private keys.

Professional indemnity insurance (PII), also known as professional liability insurance or errors and omissions (E&O) insurance, is a type of operational insurance coverage designed to protect businesses from financial losses arising out of claims relating to wrongful acts committed in the business’s provision of professional / technology services.

For more information, see our professional indemnity page

MiCA

The Markets in Crypto-Assets Regulation (MiCA) institutes undeviating EU market rules for crypto-assets. The regulation covers crypto-assets that are not currently regulated by existing financial services legislation. Key requirements for those issuing and trading crypto-assets cover transparency, disclosure, authorisation and supervision of transactions. Howden’s insurance solution aims to assist firms comply with this regulation and offers credibility and trustworthiness.

Blockchain networks using proof-of-stake as a consensus mechanism rely on validator nodes to maintain the security of the network and create / confirm new blocks on the chain. Slashing refers to the penalty mechanism imposed on validators for malicious behaviour or network rule violations. Validators may lose a portion of their staked tokens (cryptocurrency) as a penalty for actions that harm the network, such as attempting double-spending or other forms of misbehaviour.

Slashing insurance provides coverage for the financial losses resulting from penalties imposed on validators by the network for violating the rules of the blockchain. Importantly, the coverage will react in the event of an errors & omissions type incident rather than actions of an intentional bad actor.

Benefits of coverage

- Meet contractual requirements: Digital asset firms often deal with large amounts of sensitive information, including customer data and transaction details. If a firm experiences a data breach where this information is compromised, cyber insurance can help cover the costs associated with managing the aftermath of the breach.

- Business interruption: Coverage for when a slashing event results in a suspended node and therefore missed financial returns.

- Litigation defence costs: If a third party were to file a lawsuit claiming financial losses due to negligence of node operation, the legal costs associated with defending against such claims could be covered by the insurance policy.

Smart contract failure insurance provides financial protection against losses resulting from failures or vulnerabilities in smart contracts. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They are often used in blockchain-based applications and cryptocurrency transactions.

For example, an organisation that holds tokens deposited in a smart contract might, for example, purchase insurance cover to protect against those assets being drained through an error in the code.

Property insurance for crypto miners is a type of insurance coverage designed to protect the physical assets and property of businesses engaged in cryptocurrency mining activities. It aims to provide financial protection in case these assets are damaged, destroyed, or lost due to covered perils.

Benefits of coverage

- Equipment coverage: Coverage for the physical mining equipment, such as ASIC miners, GPUs (Graphics Processing Units), cooling systems, and other hardware used in the mining operation.

- Business interruption: If a covered event leads to the temporary shutdown of the mining operation, resulting in financial losses, this coverage can help compensate for lost income during the restoration period.

- Theft or burglary: Coverage is typically provided for losses due to theft or burglary of mining equipment. This can include coverage for stolen equipment and any property damage caused during the theft.

- Natural disasters: Coverage may extend to damage to mining equipment caused by natural disasters such as earthquakes, floods, or other catastrophic events.

- Power surges and electrical damage: Coverage may extend to losses resulting from power surges, electrical fires, or other electrical damage to mining equipment.

- Transit coverage: If mining equipment needs to be transported for maintenance or relocation, insurance may provide coverage for potential damage or loss during transit.

Digital assets insurance placements | |

|---|---|

2019 | Placed the first ever regulated ITO cover into Lloyd’s of London. |

2020 | Built US$45m of warm/hot crime cover for a US tier 1 client with the ability to increase specie cover to over US$1bn – include client dedicated/segregated cover. |

2022 | Developed a multi-international D&O compliant policy for a crypto exchange including Tech E&O, Cyber, EPL and Crime. Developed and placed a regulatory / investor compliant insurance programme for one of the largest digital asset firms in the UK, inclusive of bespoke coverages for individual entities across the UK, EEA and LATAM. |

2023 | Secured D&O and Crime insurance for well renowned DAO foundation, and assisted the contracted tech provider with the placement of Tech E&O, Cyber and D&O insurance. |

Global digital assets regulatory insights

Howden has the resource and capability to create and tailor products to better align with our clients’ needs, so even if a product does not exist it's worth getting in touch with one of our experts.

Meet the team

Freddie

Freddie Palmer

Freddie Palmer

Head of Digital Assets & Blockchain

Freddie joined Howden's Financial Lines Group in 2008 working in the Asset Management team before moving across to the International Financial Lines team specialising in advising clients on innovative products, facilities, bespoke wordings and capacity across the London, Berumda and European markets. For the last five years, Freddie has been at the forefront of Howden's development of new products in the Blockchain and Cyrptocurrency sectors, heading up our Blockchain and Digital Asset Risk Transfer Team.

Frankie

Frankie Fox

Frankie Fox

Associate - Digital Assets & Blockchain

Frankie joined Howden's Digital Assets & Blockchain team with a wealth of expertise in new business development. He joined as a part of the acquisition of Aston Lark where he was originally based at a boutique Financial Lines and Digital Asset specialist brokerage called Protean Risk. Known for fostering innovative solutions and cultivating strong client relationships, Frankie is now spearheading new business initiatives within the Blockchain and Cryptocurrency sectors, contributing to Howden's continued success and positioning as a leader in the evolving landscape of digital asset risk transfer.

Don't just take our word for it

Testimonials

"Howden's in-depth knowledge of digital assets and willingness to fully understand our global payments business meant we had no hesitation about engaging in their services. The team is professional and diligent from start to finish, and their expertise is evident from being a leader in the space. We would recommend Howden to those looking for a respectable broker in the insurance space."

"We would recommend Howden to firms looking for a broker with specialist knowledge in the digital assets space. From start to finish, the team had prepared clear and very well constructed presentations whilst keeping us updated and remaining responsive throughout the entire process."

"Howden were patient and understanding with a client with a heavy workload, they answered questions quickly and worked hard to understand our business. I found they were always responsive and prepared a clear, non-jargon filled presentation outlining the options."

"BCB have been extremely happy with Howden’s ability to meet our insurance needs. They have been professional and responsive in all their dealings with us."

FAQs

- Like any other company, you carry inherent risks. These are personal, so protecting the personal assets of individuals running the company.

- Making key, strategic decisions that are needed in order to drive the company forward can be thought-provoking when there is opaque regulation and framework.

- Or you may be looking to transfer risk off the company’s balance sheet in order to free up capital in order to grow.

Exposures and risk tolerance differ across the ecosystem and this will depend on what your organisation does and where they operate.

Web3 or digital asset technology companies should consider the following as critical coverages

Directors and officers (D&O) insurance: Protects the personal assets of your founders, officers and board members, and protects you from lawsuits associated with their decisions.

Errors and omissions (tech & financial institution): Protection for when a mistake in your product or service causes a financial loss to a customer or partner.

Crime/vault coverage: Protection from employee theft, forgery and fraud for example of the private keys that you hold for yourself or others, including Social engineering cover

Cyber coverage: Comprehensive protection for the cost of data breaches caused by mistakes, hacking, ransomware attacks, business interruption and denial of service attacks.

The type of insurance you require depends on the regulation, but the common pattern involves professional indemnity insurance (tech and miscellaneous) as well as coverage for data risks and cyber-attacks. There is a strong focus on safeguarding client or customer assets, so crime/vault insurance could be a pertinent risk mitigating cover.

At Howden, we are not only experienced in placing cover for some of the most common jurisdictions that regulate cryptocurrency but also have specialist offices on the ground, for example, in Dubai, Australia, Singapore, Israel, and throughout Europe, with our HQ in London quarterbacking these placements with access to our Howden One partners across North America as well.

Over the last few years, cryptocurrency hacking has become a pervasive and formidable threat, leading to billions of dollars stolen from crypto platforms and exposing vulnerabilities across the ecosystem. High losses have caused distrust against cryptocurrency businesses, especially by investors. Insurance has provided investors the ability to invest freely, without concern of any attack or omission that will wipe out all their investments suddenly. Lastly, cryptocurrency insurance also provides protection to cryptocurrency businesses for their crypto assets and customers. Thus, cryptocurrency companies can maintain their existence without any legal and economic threat, and the reliability of the sector is ensured.