Digital Health insurance

Modernised insurance for digital health organisations, covering all grey areas that you might otherwise risk being exposed to if you rely on standard insurance policies

Say goodbye to coverage gaps

Digital Health is a fast moving and evolving industry, with cutting-edge technology being developed and launched almost daily. This development is beneficial for digital healthcare businesses and customers and patients alike.

At Howden, we take pride in our dedicated team of specialist medical sector brokers who provide insurance solutions to Digital Healthcare companies, giving them the confidence to push medical, technological, and geographical boundaries.

Our key differentiator is our coverage. Being covered separately for your medical and technological operations could potentially leave some areas of your business exposed. Our coverage, on the other hand, combines these two areas into a single product to create a model that addresses aspects of your business simultaneously, providing you with a strong shield of protection.

What is Digital Health insurance?

Digital Health insurance, also known as eHealth insurance, is a tailored package of insurance precisely designed for scenarios where technology is integrated into the patient and user experience. This could be anything from AI-assisted diagnostics in hospitals to wearable consumer tech, to online GP service providers.

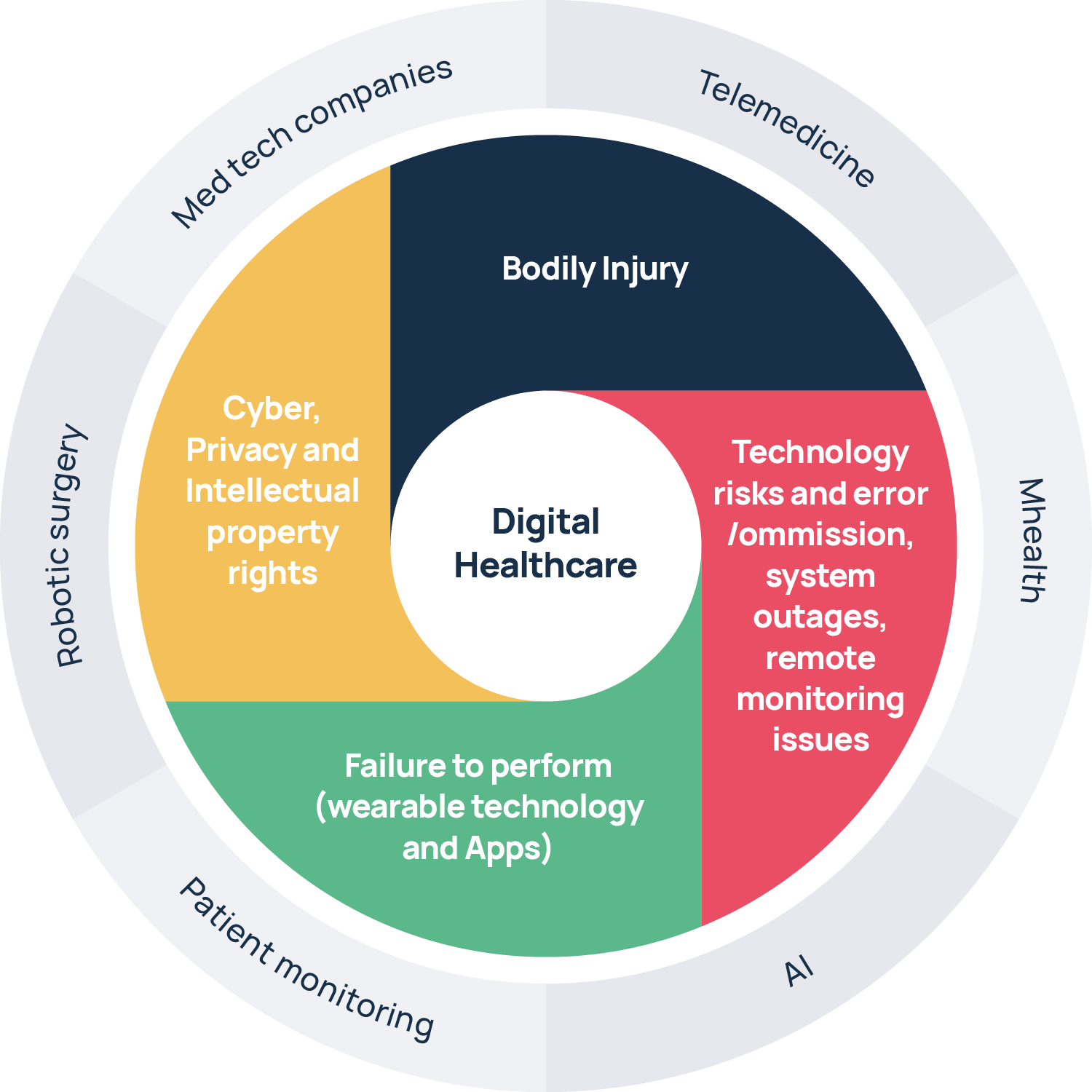

Unique risk profile of Digital Health businesses

Digital Health can mean different things to different parts of the healthcare industry. The common factor is that a medical service is combined with software in order to diagnose, treat or monitor patients.

Digital Health can help improve both efficiency and access, therefore improving the service while reducing costs. However, these benefits are not without risk: from an app failing to interpret a diagnosis or a reading correctly, an AI chat bot being programmed incorrectly or being hacked in some way, to a digital distortion of an image being sent on-line and a misdiagnosis occurring.

All these cause significant issues from an insurance perspective - is the misdiagnosis a GP error or a flaw in the software used to send the image for the diagnosis? Where does this claim sit - with the GP or with the software programmer?

What does Digital Health insurance cover?

Digital Health Insurance covers you against injuries, financial losses or property damage. Our coverage extends to a wide-range of potential risks, whether they stem from a faulty product, technological mishap, cyber threat, or human error.

Many stand-alone insurance policies can be rigid, potentially creating gaps and grey areas in coverage for Digital Health companies. Howden’s Digital Healthcare model of insurance combines all these activities, creating joint risks so you have a policy as nimble and flexible as you are.

Relying on standard insurance is risky. The gaps it leaves behind could leave you uninsured and largely affect your finances. For example, most medical liability policies exclude anything to do with a system failure, while the tech and cyber policy will exclude any bodily injury - a discrepancy you thought you had covered.

Our team of medical and technology specialists will discuss your business with you, then help to create a tailored policy to fit your particular needs.

Policy building blocks

- Medical Malpractice

- Professional Indemnity

- IP Infringement Insurance

- Product Liability

- Cyber insurance

- Employers & Public Liability

Medical malpractice insurance covers medical professionals against allegations of negligence when a patient makes a complaint.

For a digital health company, they can find the allegations come directly to them, rather than any individual health professional.

Problems arising in any tech-enabled diagnosis/ treatment provision itself are likely to be considered medical malpractice, especially when they cause harm, either physical or mental.

Of course, any investigated allegation may find the fault lay elsewhere, this could be individual errors or systematic failure of either the medical or technology side.

A fault in the software code or a server outage, for example, would usually be excluded, so a traditional malpractice policy would not respond. We add professional indemnity cover, ensuring its usual bodily injury exclusion is removed.

For any innovative tech company, IP infringement cuts both ways. People can copy your work, or you may inadvertently copy theirs.

IP cover can include:

- Defence against patent and IP infringement claims

- Contractual indemnities cover

- Loss of an intellectual property right

- Loss of future profit.

Whether you’re selling to hospitals, clinics or the public, if your products cause damage, illness or injury, it is likely a plaintiff (or group of plaintiffs) will seek compensation through the courts. Even if you didn’t manufacture the product, by selling it, you fall into the chain of liability.

Product Liability insurance protects against claims for personal injury or property damage arising from products sold by your business.

Cyber Liability is an everyday risk for digital healthcare companies who hold medical or patient data.

Cyber insurance provides cover for:

- Incident response support, including IT forensics, Legal and PR services

- Digital and data asset loss, including the cost of repair, restoration or replacement

- Business interruption cover, providing income protection while your system is down

- Defence costs, civil fines and penalties, where they are insurable by law

Employers’ Liability covers injury to your employees, with Public Liability covering both injury and property damage claims from third parties, outside of those listed above.

What does it cover?

- Bodily injury

- Personal injury (such as through defamation or slander)

- Property damage

- Legal defence.

Most companies are legally required to hold Employers’ Liability and almost no companies operate without Public Liability.

Sectors we work with

There are a number of key sectors within Digital Health that we work with:

- Life Science - Telemedicine and telehealth companies providing remote monitoring of clinical trials, products or testing procedures.

- Telehealth & Telemedicine - Telemedicine and telehealth companies provide remote monitoring of clinical trial products or testing procedures. Medical providers that use technology to deliver virtual health consultations, including diagnosis, and treatment and care recommendations and pharmacy fulfilment.

- mHealth - Technology companies focusing on wearables, apps and mobile technology to provide access to healthcare support and monitoring.

- Med Tech companies - Platforms, analytics and software developers that make digital health possible.

- Lifestyle and Wellness - Individuals and businesses supporting lifestyle and wellness choices in a variety of spheres including exercise, diet, emotional, physical and mental wellbeing.

Providers operating in these areas are wide-ranging from traditional GP’s and their Practices through to App development and device and software related services and so much more.

Real claims experiences & how our coverage helps

| Scenario | How it appears | What happened | Section of your policy that provides cover |

|---|---|---|---|

| Outdated medical advice was loaded into a diagnostic chatbot | A tech failure | A medical error | Medical Malpractice |

| Late X-ray over reads lead to a missed diagnosis | A medical error | A cyber-attack prevented the images reaching the radiologists workflow | Cyber Liability |

| The wrong prescription was sent to the patient | A medical error | A technology failure caused patient records to be switched | Professional Indemnity Technology E&O |

Meet our expert team

Richard

Richard Hearn

Richard Hearn

Divisional Director - Head of Digital Health

Richard has been involved in the healthcare arena since 1992. He is a specialist in insurance and risk programs for larger corporate clients that predominantly fall within the top 500 in the UK by revenue.

He heads up the Digital Health and Social Care teams at Howden and possesses great leadership qualities that allow him to encourage the teams to always deliver impeccable service to all our clients from small, to SME and corporate.

Frequently asked questions

You may have patients overseas or employees working remotely, which means you could be summoned to face a claim anywhere in the world. We can adapt your policy to fit your global footprint so that your insurance is ready to respond, wherever you need it.

As a leading independent insurance broker, we’re free to choose from a wide range of providers, to create the most comprehensive and suitable policy for you. Howden has established partnerships with some of the world’s leading providers of Medical Insurance underwriting and risk management services. We only use minimum A-rated insurers with experience of the unique complexities of the medico-legal industry. All claims are handled with the utmost professionalism by trusted and experienced staff with in-depth knowledge of the field.

In short, yes. eHealth is very much focused on communication technologies for healthcare purposes. Digital health includes (mHealth) apps, electronic medical records, wearable devices and telemedicine, it is a term used to describe the transformation of technology for healthcare. The scope of cover however required by both is very similar.

Many Healthcare businesses will sit across both the healthcare and technology sectors. Digital health insurance offers protection for Healthcare businesses using technology and digital devices to provide services. Risks are varied from the failure of a healthcare device or App that leads to body injury to hackers and cybercriminals who may look to manipulate Apps and AI systems, and many other risks.

Business that use Digital Health platforms and technologies, would be considered a digital health business. There is a wide range of such technologies, from GP services and general wellness Services, to diagnostic and medical products (drugs, wearables and devices), through to research and development trials to develop or study medical products.