Structured Solutions

Insurance solutions for esoteric risks

Howden’s Structured Solutions team works exclusively on the application of insurance to esoteric risks with a particular focus on situations where insurance creates value greater than the cost of the risk transfer.

We work with businesses and their advisers across a range of sectors and specialisms, including investment management, financial services, litigation and arbitration, insolvency and restructuring, special situations and mergers and acquisitions.

Where can we add value?

Every situation we work on is different and we will work closely with you to understand your requirements and design the optimal solution. There are however common themes to many of the problems we have helped to solve.

Typically our clients are motivated by one or more of the following:

- Cash release

- Facilitating a transaction

- Catastrophe protection

Why choose Howden?

We believe that insurance brokers should be more than intermediaries. We are a team with advisory experience across legal, accounting, banking and insurance backgrounds and first-hand knowledge of our clients’ perspectives and requirements.

We are driving innovation in the insurance market to provide truly bespoke solutions which meet those requirements.

Our aim is to become an extension of your team, as trusted advisers providing a personal and responsive service throughout.

Our process

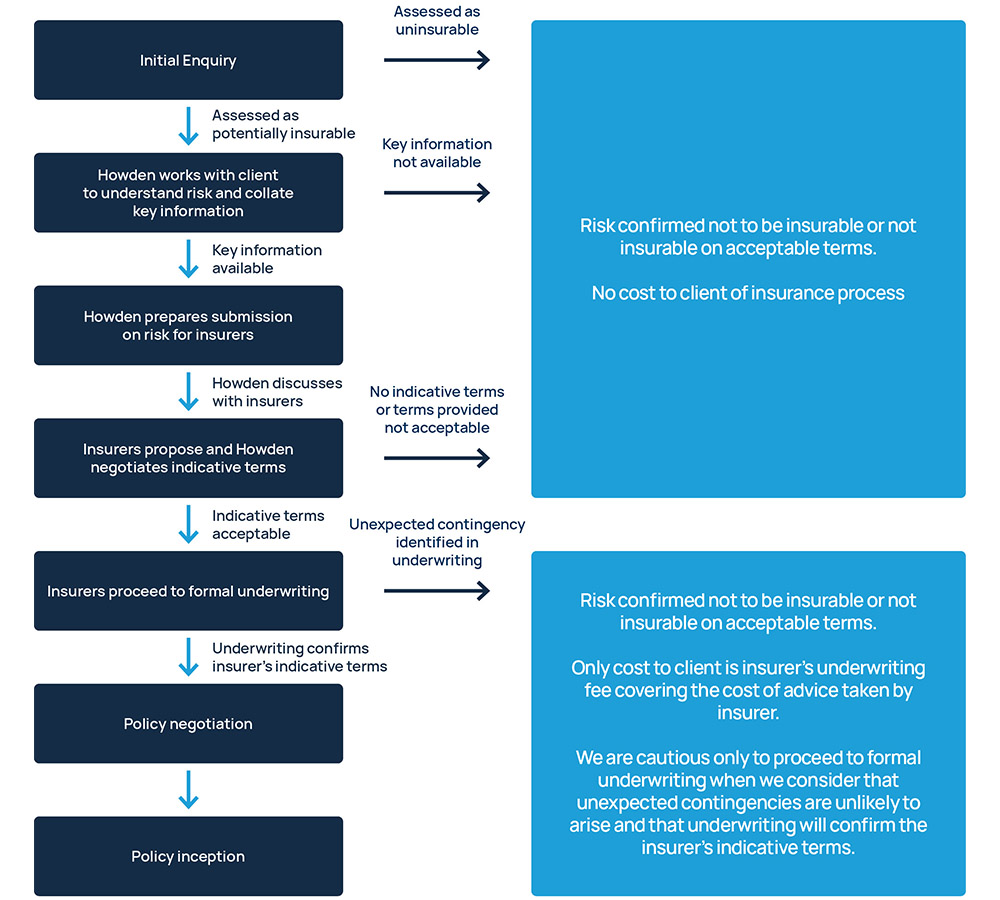

Our focus on esoteric risks gives us unique insight into insurer appetite and the art of the possible in the role of insurance in structuring a transaction.

We quickly identify where a risk is not insurable to avoid wasting your time. Where a risk is potentially insurable, we take a true advisory approach and work with you and your advisers to source information to allow us to present the risk to insurers in the way that ensures the best possible prospect of obtaining a viable solution.

Process and timing vary significantly from risk to risk and depend on various factors including; the

availability of information at the start of the process, the number of parties involved and the extent to which their interests diverge, and the timing of any underlying transaction.

The following flowchart provides a high level indication of the relevant phases. We can quickly provide more detailed guidance on your particular enquiry following a brief introductory call.

Global reach, personal touch

As part of Howden we combine our boutique advisory approach with the leverage of a global insurance group.

Starting out in 1994 with just three friends and a dog, Howden is now a global broker offering a wide spectrum of insurance products and services but retaining the agility and responsiveness which has fostered our significant growth.

With a presence in over 90 territories, the Howden One broking network places over $9bn in broking premium annually.

Central to Howden’s company values is our ‘owner’s mindset’. Our employee ownership model means that our people are invested in what they do. We go above and beyond to provide excellent service and results for our clients.

Meet the team

Alex

Alex Southby

Alex Southby

Head of Structured Solutions

Alex leads the Structured Solutions team at Howden, working closely with clients and their advisers to develop insurance solutions that create value from esoteric situations. Additionally, Alex is responsible for driving new product innovation.

Throughout Alex’s career he has assisted clients in their analysis of complex legal and factual issues, and latterly in structuring transactions to mitigate the attendant risks.

Before joining Howden, Alex practised as a dispute resolution solicitor at Travers Smith, working across a broad range of commercial and financial services litigation and investigations. During his time there he was selected to be a Judicial Assistant in the Court of Appeal where he assisted Lady Justice Hallett with the Hallett Review into the ‘on-the-runs’ administrative scheme.

Charlie

Charlie Langdale

Charlie Langdale

Managing Director

Charlie brings over 20 years’ experience in insurance for financial institutions. He now oversees all areas of Howden’s Financial Lines practice, including client service, product innovation and insurance market strategy and relationships.

The Financial Lines division works with a range of clients, primarily hedge funds, banks and private equity houses. The division is made up of over 330 people and places over £600 million of premium into the insurance market every year.

Charlie is also heavily involved in Howden’s CSR activity, chairing the Sustainability Product Working Group and an active member of the charity committee.

Nick

Nick Minns

Nick Minns

Associate Director

Nick works within the Structured Solutions team, working with a range of clients to create value through insurance that is higher than the cost of the risk transfer.

Bringing expertise from the Accountancy and Banking sectors, Nick has a particular focus on finance and capital solutions and product development.

Before joining the Structured Solutions team, Nick held roles at Barclays including front office structuring in the investment bank, regulatory capital, green finance and treasury. He is also a qualified accountant, practicing at PwC before moving to banking.

Victoria

Victoria Maynard

Victoria Maynard

Account Executive

Victoria supports the Structured Solutions team with client servicing and coordination, including the organisation of meetings with underwriters and clients. She also contributes to product innovation projects, delivering product research and proposals.

Victoria also a member of the Sustainability Product Working Group which helps drive the sustainability agenda within Howden’s offering.

Outside of her core role, Victoria is completing her Chartered Institute of Insurance qualifications, having already completed her Certificate in Insurance. She is also a keen ballet dancer and has danced from a young age.

Jamie

Jamie Baty

Jamie Baty

Account Executive

Jamie supports the Structured Solutions team, carrying out research projects and assisting in product innovation and delivery.

He has a degree in French and Portuguese, and has studied Brazilian guitar in London and São Paulo.