Financial planning and advice

At Howden, we believe that great financial planning is about more than numbers – it’s about people and what is important to them. Whether you are planning for retirement, growing your business or have other financial goals in mind, we are here to guide you. Helping you protect what's important and to plan for the future.

Our approach

Our approach is simple. Our financial planning process is built for you and around you. By listening to you, understanding your goals and keeping them at the centre of everything we do, we help our clients to answer the overarching question - “Will we be ok?”.

Whether you're a busy professional, a company executive, a business owner or planning for retirement, we’re with you every step of the way on your financial planning journey - to give you clarity, peace of mind, and build lasting trust, so you can focus on what truly matters to you.

Helping you answer - Will we be okay?

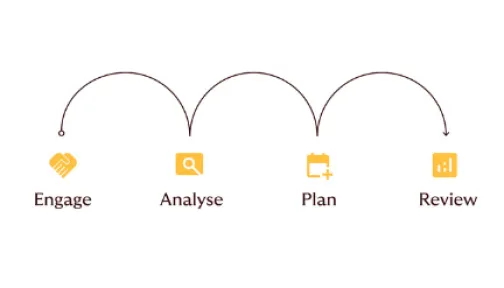

By understanding what matters most to you, we guide you through your financial planning journey giving you clarity and confidence. From your initial conversation with us to regular reviews, our structured approach - Engage, Analyse, Plan, Review - ensures your financial strategy grows and adapts alongside your life.

Our services

Lifestyle financial planning

Protect what’s important

Retirement planning

Estate planning

Investing

Wealth Management

Why choose Howden?

Our Financial Advisory team take great pride in working with our clients - we don’t just manage financial requirements we help you plan and build for your future.

Our expert team is committed to understanding your financial aspirations and life goals, crafting long-term strategies to deliver successful outcomes. Getting to know your goals in-depth we focus on developing a deep relationship with you.

Whether you come to us for individual or business financial advice and planning, we build trust, and give you expert financial guidance every step of the way to navigate life and business. All with confidence and clarity. We look forward to working with you now and for many years to come.

Frequently asked questions

A financial advisor helps you make informed decisions about your financial goals and aspirations. From investments and insurance to retirement planning, we tailor our advice to your personal situation or business requirements.

Financial advisory typically focuses on goal-based planning and guidance across investment, protection and retirement. Wealth management includes investment and portfolio strategies. At Howden, we combine both in one personalised service.

There’s no strict minimum, but our services are best suited to individuals or couples with complex financial needs - such as business owners, professionals, directors and CEO's.

Our advisors provide unbiased, regulated advice that’s compliant with Irish financial services authority standards. Your best interests are always at the centre of everything we do.

Yes. We specialise in aligning your personal wealth with your business strategy - including exit strategies, executive benefits and succession planning.

We offer both. Many clients begin with a one-off consultation and continue into an ongoing relationship where we provide strategic reviews, investment updates, and proactive planning support.