Managing Manufacturing Risks

Manufacturing is evolving. Your insurance should too.

With evolving changes in the manufacturing industry, companies face evolving risks in their course of business operations. Traditional insurance policies can be rigid, potentially creating gaps and grey areas in coverage for manufacturing companies.

The gaps could leave you uninsured for a crippling loss.

Potential scenarios arising from insurance gaps

1. Interdependency in operations worldwide

A fire breaks out in Plant A and affects production at Plants B & C.

Your property insurance for Plant A will pay for fire damage and interruption losses of Plant A, but the property insurance for Plants B & C will will not cover business interruption losses there since there is no damage or incident at these plants.

2. Sub-contracting work to entities worldwide

A fire breaks out in a client's premise due to a sub-contractor's negligence in another country, causing the client and third parties property damage and bodily injuries.

Your liability insurance in Singapore will not pay compensation to third parties since there was no negligence on the part of your Singapore office.

If you have liability insurance for the other country, it will pay compensation to third parties but may not be sufficient to cover all legal and compensation costs.

3. Product recalls

You discover an unsafe product or manufacturing defect in your product and have to recall from the market.

Typical product liability insurance does not cover product recall costs and expenses, which can include setting up a crisis team, recall notification, transport of products, disposal, investigation, litigation, loss in sales, and fines and penalties.

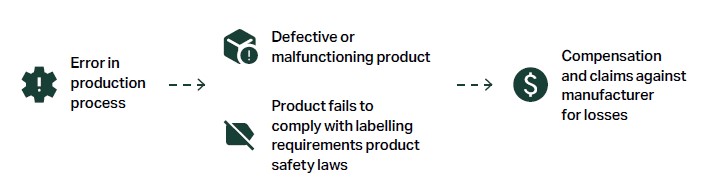

4. Manufacturing errors and omissions

An error in your production process results in a defective product or products that fail to comply with product safety laws, which leads to compensation and claims against you for losses.

Liability or property insurance does not cover these costs since there is no property damage or bodily injury.

5. Cyber attacks

A security breach in your IT system leads to shut down of your manufacturing plant. Potential costs and expenses include ransom or extortion payments, media, PR, IT forensics, loss of profits from downtime etc.

Liability or property insurance does not cover these costs since there is no property damage or bodily injury.

Bridge your insurance gaps

It is vital to close potential insurance gaps and manage operational risks and any other emerging risks with the help of new customised insurance solutions that exist today to cover you against injury, financial loss or property damage:

- Property Damage & Business Interruption: Protect against financial losses as a consequence of an insured property damage

- Liabilities Across Related Entities: Claims for injury to third parties and/or damage to their property

- Product Recalls: Cover the expenses arising from recalling and/or replacing defective goods

- Manufacturing Errors & Omissions: Protects against financial losses arising from manufacturing errors and omissions

- Cyber Losses: Protects against financial losses arising from cyber attacks