Delivering world class Surety solutions globally

What is Surety?

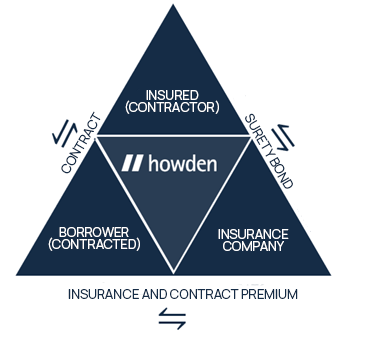

Surety is the instrument by which the fulfilment of a contractual obligation of a company (borrower) can be guaranteed for the benefit of its contractor (insured). In addition, surety can also be used to secure legal proceedings in the civil, labour or tax spheres.

Why choose Howden?

- Pricing: consistently delivering competitive terms;

- Market influence: with excellent relationships in the market, we have excellent buying power;

- Bespoke solutions: we offer individual and efficient solutions for each client, according to their needs;

- Global & local solutions: facilities on a local, regional or global basis;

- Delivery capacity: access to all major providers ensures all capacity options are fully explored;

- Industry expertise: expertise across multiple industry sectors.

- Document analysis: highly capacitated and qualified professionals to analyze great risks.

Surety Bond Types

Surety is traditionally divided into two categories: Contract and Judicial. The main modalities are:

| Contract | Judicial |

|---|---|

|

|

Surety is widely used amongst private companies and with legal provision for its admissibility, in the case of public companies, being essential for many sectors, in view of the cost reduction in relation to other forms of guarantee.

Advantages of Surety Bonds in relation to others forms of security

More attractive rates: unlike band bonds, which generally has a more objective analysis, in Surety the rate for contracting an insurance will follow the company´s financial situation, as well as its expertise to perform its activities;

Does not compromise its cash flow: surety will work as service contracting and therefore does not restrict the company's credit limit with banks;

Use of credit for investments: with bank credit lines available, the company can use it for other projects, promoting the investment in its activities;

Greater security for the companies that are contracting: the basic principle of surety is to ensure the faithful fulfilment of a contract, giving greater reliability to the Contractor in the completion of its projects;

Speed in contracting: the contracting of the insurance is done quickly and less bureaucratically.