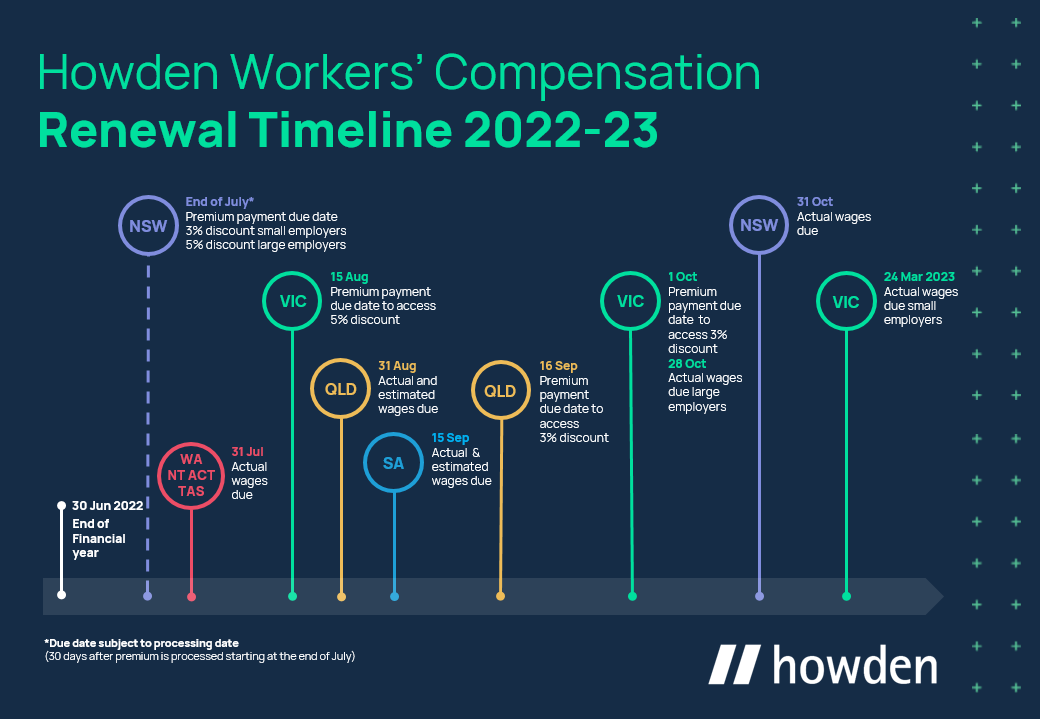

Workers' Compensation Renewal Timeline

Workers' Compensation Renewal Timeline for policies renewing on June 30

Worker’s Compensation policies are administered within state based jurisdictional boundaries.

This leads to a renewal timeline with a variety of key dates across different states, presenting administrative challenges for national employers.

We have developed three resources to assist:

1. Workers' Compensation renewal timeline (overview)

2. National Key Dates Renewal Timeline (detailed)

3. National Worker's Compensation Wage Matrix (download)

Here is the National Key Dates Renewal Timeline and table as a resource for national employers with policies expiring June 30.

| STATE | RENEWAL/ONLINE SYSTEM | CERTIFICATE OF CURRENCY for 22/23 | REMUNERATION SUBMISSION DUE DATE | PREMIUM DISCOUNT FOR UPFRONT PAYMENT |

| NSW | Policy Renewal Packs distributed electronically by Icare from 8th June 2022. *Small ER's will receive policy calc for 22/23 as they are not experience rated. | Certificates of Currency contained within the Renewal Pack issued from 8 June 2022. | If estimated wages are not updated, Icare will automatically renew using expiring estimated wages + 2.6%. Actual wages for 21/22 must be completed by 31 October 2022. Estimated wages can be updated and Actual wages lodged at the Icare portal.

| 3% discount available on premium for medium and large employers (APP greater than $30K) if paid within 30 days of calculation. 5% discount available on premium for small employers (APP less than $30K) if paid within 30 days of calculation. |

| VIC | Policy Premium Renewal notifications available online from 7 July 22. Click here | Certificates of Currency available from 8 June 2022. Click here | Estimated wages for 22/23 can now be updated online. We recommend this is submitted prior to 30 June 2022 to ensure correct wages are reflected in first renewal notification issued and available online from 7 July 2022. Actual wages for 21/22 due by 28 October 2022 (large employers) or 24 March 2023 (small employers). | 5% discount available on premium if paid by 15 August 2022. 3% discount available on premium if paid by 1 October 2022. |

| QLD | The Queensland online portal is open from the 1 July 2022 to submit annual remuneration. Click here | Interim Certificates of Currency can be downloaded online with currency until 30 Sept 2022. A full year 22/23 Certificate of Currency will not be available until wages have been submitted and premium calculated. | Actual & Estimated Wages must be completed by 31 August 2022. | 3% discount available on premium if paid by 16 September 2022. |

| SA | The SA online portal is open from 2 July 2022 to submit annual remuneration. Click here. | Certificate of Current (Registration) for full year 22/23 available online from the 9 June 2022. | Remuneration must be declared by the 15 September 2022. When you complete the employer remuneration return you can choose to have your 22/23 premium calculated based on either: • the actual remuneration paid to workers in the 21/22 financial year, or • the estimated remuneration you expect will be payable to workers during the 22/23 financial year. | No discount available on premium for upfront payment. You can elect to pay in 9 equal instalments or upfront. The first instalment or annual payment is due 7 October 2022. |

| RISK STATES (WA, ACT, NT, TAS) | Howden will contact you directly re Estimated Wages & Terms. | Certificates of Currency for the 22/23 policy year are issued by the insurer and then provided by Howden 24 hours after acceptance of terms. | Actual Wages must be submitted by 31 July 2022. | No discount available on premium for upfront payment. |

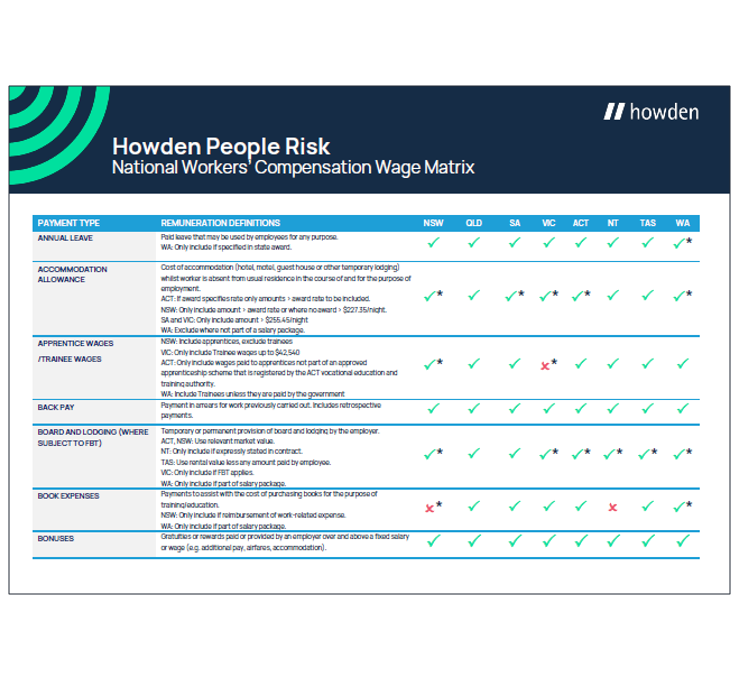

Workers' Compensation Wage Matrix

With remuneration being one of the key drivers of premium payable, it is important that employers calculate and declare their remuneration accurately.

Howden have developed a Wages Declaration Matrix to help employers navigate what is rated as remuneration in each jurisdiction.

Download our free copy of our Workers' Compensation Wage Matrix.