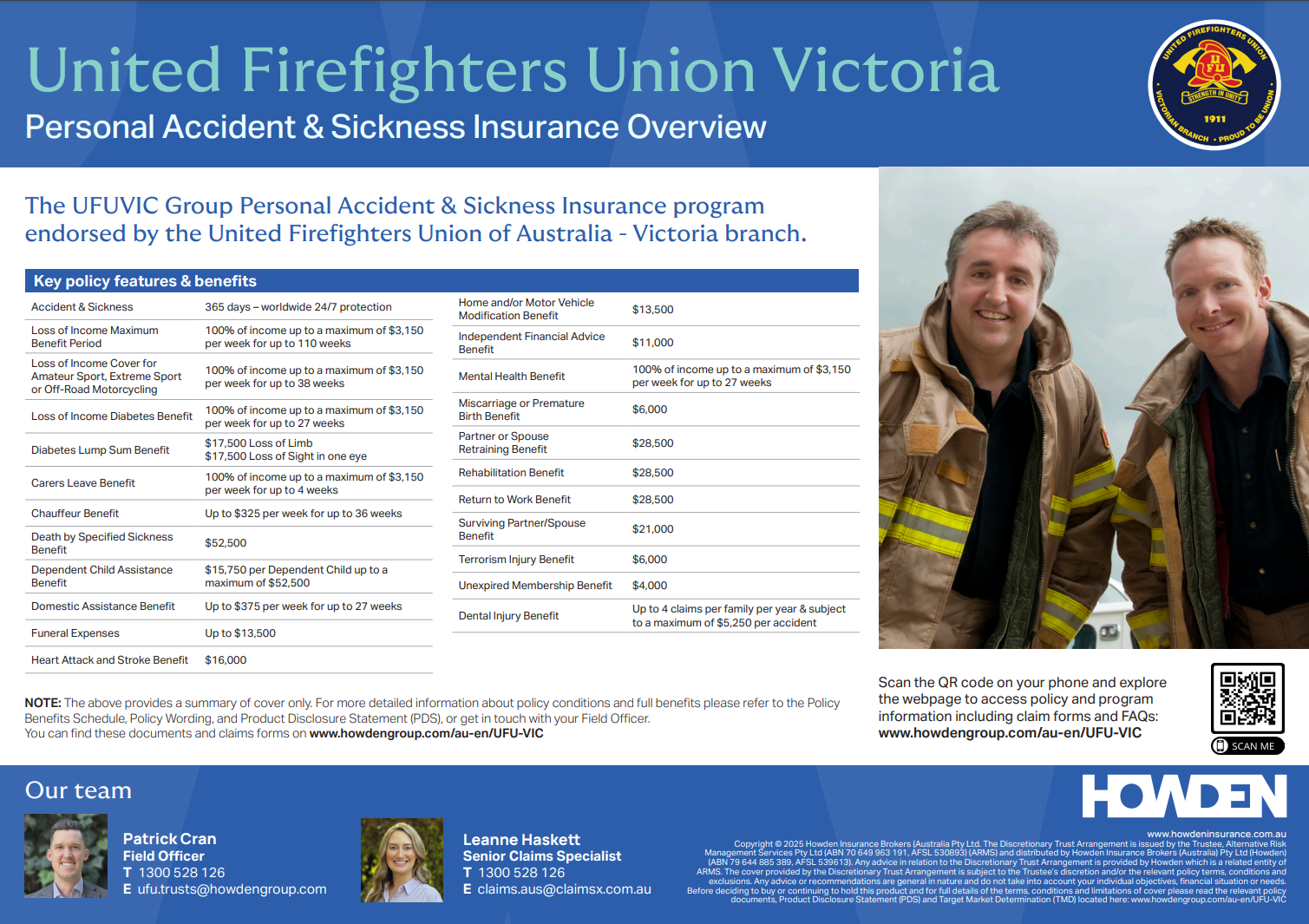

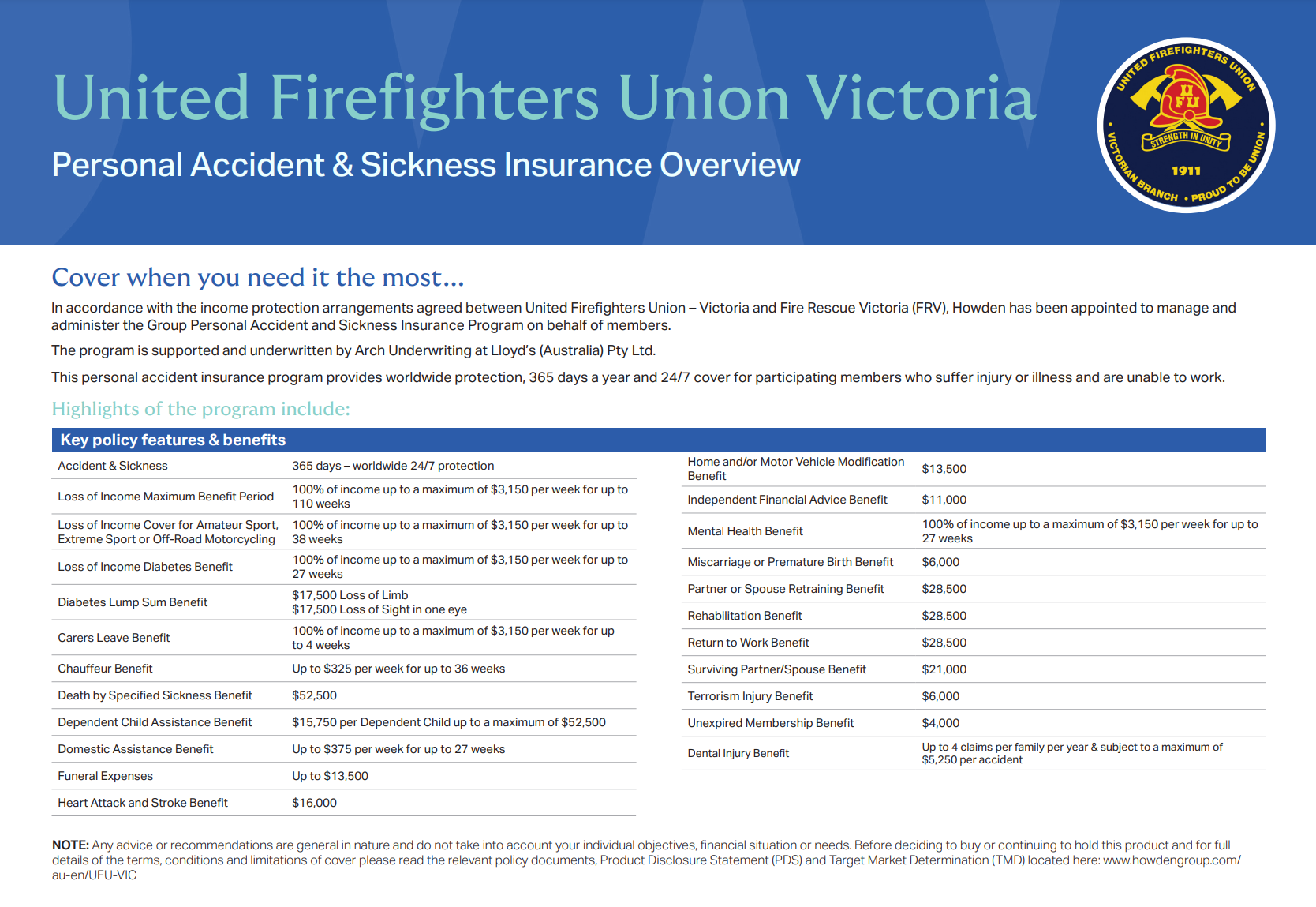

Personal Accident & Sickness Insurance for UFUVIC Members

Taking care of you during your down time

Howden & United Firefighters Union Victoria: working together

|

|

Highlights of the program include:

| Accident & Sickness | 365 days – worldwide 24/7 protection |

| Loss of Income Maximum Benefit Period | 100% of income up to a maximum of $3,150 per week for up to 110 weeks |

| Loss of Income Cover for Amateur Sport, Extreme Sport or Off-Road Motorcycling | 100% of income up to a maximum of $3,150 per week for up to 38 weeks |

| Loss of Income Diabetes Benefit | 100% of income up to a maximum of $3,150 per week for up to 27 weeks |

| Diabetes Lump Sum Benefit | $17,500 Loss of Limb $17,500 Loss of Sight in one eye |

| Carers Leave Benefit | 100% of income up to a maximum of $3,150 per week for up to 4 weeks |

| Chauffeur Benefit | Up to $325 per week for up to 36 weeks |

| Death by Specified Sickness Benefit | $52,500 |

| Dependent Child Assistance Benefit | $15,750 per Dependent Child up to a maximum of $52,500 |

| Domestic Assistance Benefit | Up to $375 per week for up to 27 weeks |

| Funeral Expenses | Up to $13,500 |

| Heart Attack and Stroke Benefit | $16,000 |

| Home and/or Motor Vehicle Modification Benefit | $13,500 |

| Independent Financial Advice Benefit | $11,000 |

| Mental Health Benefit | 100% of income up to a maximum of $3,150 per week for up to 27 weeks |

| Miscarriage or Premature Birth Benefit | $6,000 |

| Partner or Spouse Retraining Benefit | $28,500 |

| Rehabilitation Benefit | $28,500 |

| Return to Work Benefit | $28,500 |

| Surviving Partner/Spouse Benefit | $21,000 |

| Terrorism Injury Benefit | $6,000 |

| Unexpired Membership Benefit | $4,000 |

| Dental Injury Benefit | Up to 4 claims per family per year & subject to a maximum of $5,250 per accident |

NOTE: Any advice or recommendations are general in nature and do not take into account your individual objectives, financial situation or needs. Before deciding to buy or continuing to hold this product and for full details of the terms, conditions and limitations of cover please read the relevant policy documents, Product Disclosure Statement (PDS) and Target Market Determination (TMD).

The Discretionary Trust Arrangement renewed on 8 March 2025 at 4pm (est) providing additional cover and increases in some policy limits.

Claims for incidents occurring prior to the renewal of the program will be managed in accordance with the previous cover in place for the period 8 March 2024 at 4pm (est) to 8 March 2025 at 4pm (est). If you would like more information on the previous cover, please contact us.

Important documents

You will find the Policy Schedule, Policy Wording, and Product Disclosure Statement (PDS) here.

The Discretionary Trust Arrangement is issued by the Trustee, Alternative Risk Management Services Pty Ltd (ABN 70 649 963 191, AFSL 530893) (ARMS) and distributed by Howden Insurance Brokers (Australia) Pty Ltd (Howden) (ABN 79 644 885 389, AFSL 539613).

Any advice in relation to the Discretionary Trust Arrangement is provided by Howden which is a related entity of ARMS. The cover provided by the Discretionary Trust Arrangement is subject to the Trustee’s discretion and/or the relevant policy terms, conditions and exclusions.

We are here to help

If you have a question about the insurance program, how it works, and what it covers please get in touch with your Field Officer:

Patrick Cran

UFUVIC Field Officer

T 1300 528 126

E [email protected]

If you have a question about how to claim, your existing claim, or past insurance claim please get in touch with your Claims Manager:

Leanne Haskett

UFUVIC Claims Manager

T 1300 528 126

E [email protected]

If you have a claim

Claim forms

Here are the claims forms for making a claim on your Personal Accident & Sickness policy:

- Personal Accident & Sickness Claim Form

- Funeral Benefits Claim Form

- Accidental Death Claim Form

- Broken Bone Claim Form

- Dental Injury Claim Form

Claim lodgement process

Please email your completed claim form and supporting documentation to [email protected].

If you have any questions or need an update please contact your Claims Manager by using the above email address or on the following number 1300 528 126.

Ambulance Victoria membership

How to claim your reimbursement

If you have Personal Accident & Sickness insurance cover as a member of the UFUVIC, you are eligible for an Ambulance Victoria membership reimbursement:

- Purchase or renew your 12-month single or family membership via Ambulance Victoria.

- Send your receipt and your banking details to our Claims Manager at [email protected].

- The full membership amount will be reimbursed to you.

- Each year when you renew your membership, just follow the same process for reimbursement.

Ambulance reimbursement FAQs

If you have Personal Accident & Sickness insurance cover as a member of the UFUVIC, you are eligible for an Ambulance Victoria membership reimbursement. The process is as follows:

- Purchase or renew your 12-month single or family membership via Ambulance Victoria.

- Send your receipt and your banking details to our Claims Manager at [email protected].

- The full membership amount will be reimbursed to you.

- Each year when you renew your membership, just follow the same process for reimbursement.

If you have a questions please get in touch with your Claims Manager.

If you are already a member of Ambulance Victoria and then join the group personal accident program, we will reimburse the portion of your annual Ambulance Victoria Membership from the date you joined the group personal accident program when you next renew your Ambulance Victoria membership.

Make sure you maintain your cover, and renew your 12 month Ambulance Victoria single or family membership before the expiry date.

Send your receipt and your banking details to our Claims Manager at [email protected].

Make sure you let us know how many additional months you will need to be reimbursed for - from taking out your Personal Accident & Sickness insurance, until the beginning of your Ambulance Victoria renewal.

For example: If you have 3 months left of your existing Ambulance Victoria membership, please renew your membership before expiry for 12 months. You will be reimbursed at that time for the 12 month annual membership fee plus the 3 months of previous cover (calculated pro-rata from the annual membership fee).

You should receive your receipt via email, or you can access a copy via your online account with Ambulance Victoria. Simply log on and click on Members Area menu option, and select Login and Renew. All your past receipts can be found there.

If you can't log in to your account to access your receipt, contact Ambulance Victoria:

T 1300 366 141

E [email protected]

W www.ambulance.vic.gov.au

No, it will remain your responsibility.

You will need to renew and pay your Ambulance Victoria membership on an ongoing basis. As long as you have your Personal Accident & Sickness insurance cover you will be eligible for reimbursement.