Climate risk is business risk: how insurance can unlock resilience and trust in the ASRS era

Starting in January 2025, the Australian Sustainability Reporting Standards (ASRS) ushered in a transformative shift in corporate accountability, mandating climate-related financial disclosures for eligible entities. Grounded in the globally recognised IFRS framework, these standards require companies to report on climate risks and opportunities, greenhouse gas emissions, decarbonisation strategies and targets, and the integration of climate considerations into strategic decision-making. This marks a significant evolution in how businesses manage risk and sustainability, with phased assurance requirements to follow over time.

However, what companies must recognise is that this is no longer a compliance exercise - it’s a strategic necessity.

This development in the ASRS demands a proactive and forward-looking approach to derisking operations and decarbonising value chains. Businesses must now integrate climate risk into their core operations, and insurance is emerging as a powerful enabler of resilience and innovation in doing so. Howden, in partnership with Parvate ESG, can assist in this specialised field by embedding sustainability into the core of your business model.

Getting to grips with the ASRS – from optional to operational

It goes without saying that the first step in this new ASRS era is understanding your reporting obligations. Detailed disclosure standards have now been formalised, and one key takeaway is that sustainability reporting will become an annual necessity for entities subject to these standards. The Sustainability Report will be lodged with ASIC at the same time as other reports (e.g. Financial, Directors’ and Auditor’s report) and requires entities to disclose information regarding climate-related risks and opportunities useful to users of General Purpose Financial Reports in making decisions relating to providing resources to the entity. These are being implemented at three different stages depending on whether your company falls into Groups 1, 2 or 3, which is determined by company size and financial threshold. First annual reporting for Group 1 = on or after January 2025, Group 2 = on or after July 2026, Group 3 = on or after July 2027.

However, companies that fall into group 2 or 3 should avoid taking a back seat as many are inextricably bound by the demands of Group 1. We are already seeing Group 1 companies in retail, manufacturing and food demanding sustainability information from their suppliers in groups 2 or 3, to fulfill their value chain assessments. Although sustainability reporting might not yet be legally required for these businesses, they must be prepared to answer questions from their clients in the first wave of reporting companies. Suppliers that get ahead on sustainability reporting will undoubtedly gain a competitive edge, and those that don’t will risk falling behind. Howden and Parvate ESG are partnered to offer tailored guidance to help businesses interpret and operationalise ASRS requirements, ensuring readiness across all reporting groups.

So, what are the reporting pillars?

- Governance – outlines the systems, controls, and procedures an organisation uses to oversee and manage climate-related risks and opportunities.

- Strategy – describes how climate risks and opportunities are factored into the organisation’s strategic planning and long-term objectives.

- Risk management – details the processes for identifying, assessing, prioritising, and monitoring climate-related risks and opportunities, and how these are embedded within the broader risk management framework.

- Metrics and targets – explains how the organisation measures and tracks climate-related risks and opportunities, including performance indicators such as progress toward decarbonisation targets.

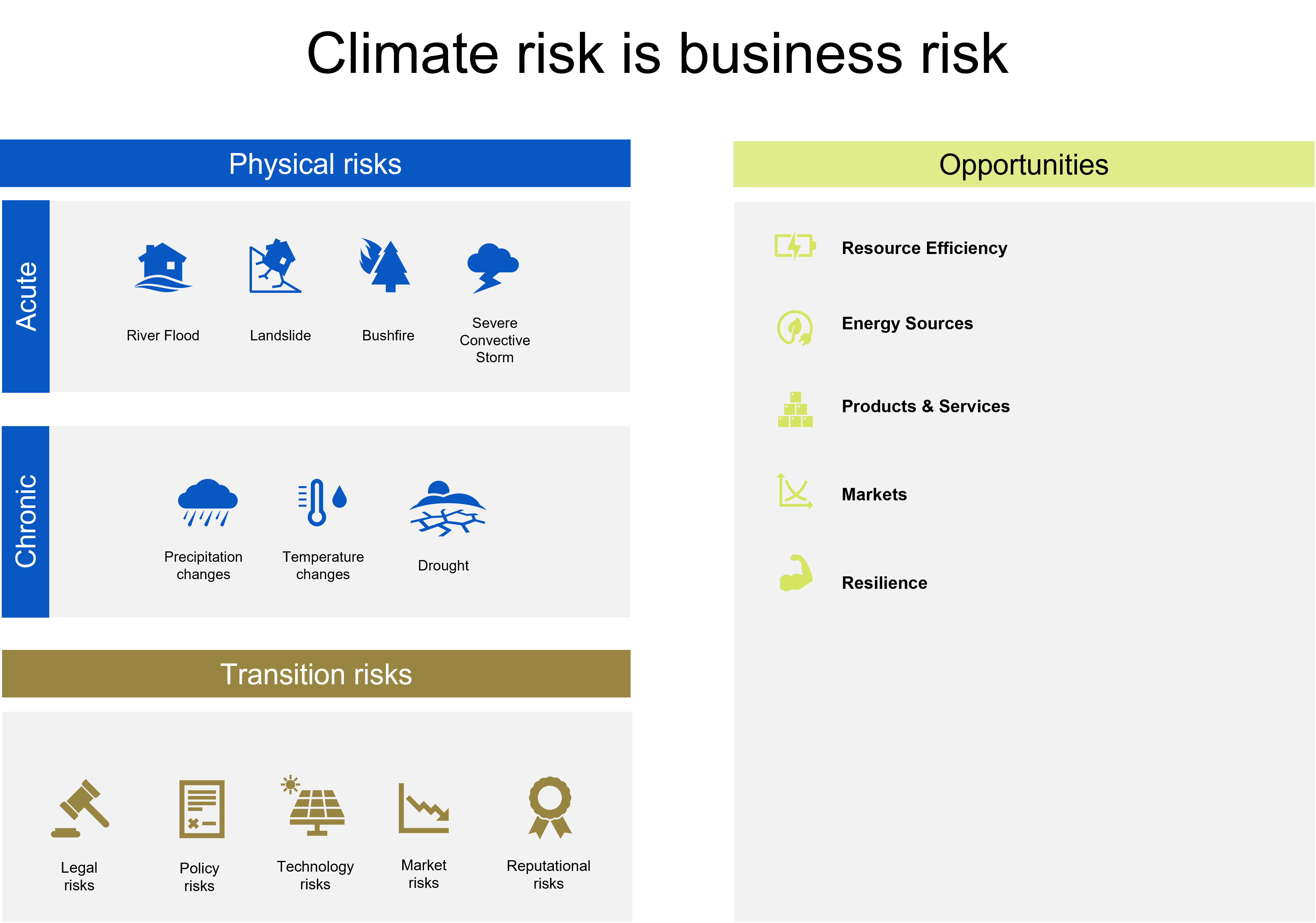

| Physical risk case study | Opportunities |

|---|---|

Take, for example, a commercial property located in Lismore - a town highly vulnerable to flooding and one that has experienced multiple severe flood events in recent years. Due to its location, the property faces significant insurability challenges, including rising premiums or the potential unavailability of coverage. Rather than continuing to absorb these escalating costs or resorting to self-insurance, the business could consider operational adjustments to reduce its flood exposure. This might include relocating critical infrastructure to higher floors, redesigning ground-level areas to minimise damage from water ingress or investing in flood mitigation measures, whether that be engineered solutions or nature-based defences. These strategic investments not only reduce the property's vulnerability but also help stabilise insurance costs and improve coverage availability over the long term. Insurance expertise plays a key role here, as it enables the quantification of risk in financial terms, translating flood exposure into measurable impact and demonstrating the value of mitigation efforts. Ultimately, this approach strengthens asset protection, enhances insurability, and supports the long-term resilience and performance of the business. | All these risks are material, and financially significant. Yet within these risks lies a goldmine of opportunity – the bold businesses that act first won’t just meet compliance obligations; they’ll gain a great advantage leaving their competitors in the shadows.

|

As financial institutions increasingly align with sustainability principles, insurers play a critical role in incentivising climate-conscious business strategies. Just like banks that reward customers with easier access to or lower-cost capital for progressive decarbonisation strategies, helping reduce their financed emissions, insurers can offer more favourable terms to companies demonstrating robust climate risk management. Businesses that are proactively assessing and mitigating their exposure to climate risk, spanning the whole supply chain, not only strengthen their resilience but also become more attractive partners to insurance companies. In this way, insurance becomes a strategic enabler of sustainability-aligned investment, driving better environmental outcomes and long-term business sustainability.

Insurance as a strategic enabler of resilience

As of 2025, the climate crisis represents one of the most critical and complex challenges confronting businesses worldwide. However, in Australia these impacts are particularly acute. Businesses face heightened exposures given the country’s size and geographic position. As climate-related risks are set to only intensify, companies must navigate growing regulatory pressure and shifting stakeholder expectations.

Climate resilience is therefore not just a sustainability issue, but a core business imperative.

Insurance needs to be seen as a key enabler for building resilience within your business. Partnering early is vital in de-risking the climate challenge by unlocking investment and protecting businesses, assets, nature and livelihoods.

Businesses must look beyond traditional coverage. Directors and Officers (D&O) insurance is becoming increasingly critical in the ASRS era as Directors are now personally accountable for the accuracy and completion of climate-related disclosures. Governance failures can lead to significant legal and financial consequences. D&O insurance provides essential protection for leadership teams navigating these increased responsibilities, ensuring that strategic climate action is supported by robust executive risk management.

Whilst the risk landscape has significantly changed in recent years to now include escalating climate risks, volatile geopolitical relations and cyber security risks resulting from advancing technology; it has also left a promising and profitable space to transform, rather than simply transfer these risks.

Insurance should be seen as a tool to unlock investment in:

- Low carbon infrastructure – this enables projects, reduces volatility and unlocks project financing which ultimately drives both economic and environmental returns.

- Nature and carbon markets – strengthening the integrity of carbon and nature projects through robust standards, transparent methodologies, and credible verification ensures that these projects deliver real, measurable outcomes.

The power of parametric insurance

Insurance expertise can play a key role in helping your business assess the significance of climate risks and guide investment decisions to enhance resilience. Insurance solutions also enable you to transfer these risks to the market. If traditional insurance doesn’t reflect the value of your resilience measures, you have the option to design tailored parametric insurance that activates only when those measures are breached. In doing so, you retain control over the assumptions underpinning your coverage—with Howden’s support - rather than relying on insurers to define them for you.

Case studies:

- If a property invests in flood defences or relocates critical equipment to higher levels but doesn’t receive a corresponding reduction in insurance premiums, parametric insurance offers a practical alternative, especially when traditional insurers fail to accurately assess your risk. With parametric cover, a sensor can be installed at your property to monitor flood levels. The insurance is triggered only when water exceeds the height of your flood defences. In this setup, the defence height effectively serves as the policy excess, ensuring you’re not paying for coverage below that threshold.

- Traditionally, parametric crop insurance has relied on proxies like rainfall, soil moisture, or temperature to estimate yield. However, a more advanced solution now enables coverage based directly on a farmer’s yield per hectare, using data from IoT devices and modern farming machinery. By insuring actual yield rather than relying on indirect indicators, this approach reduces the risk of mismatch between the proxy and the farmer’s true loss.

Simulate, strategize, safeguard: the power of climate risk modelling

Utilising cutting-edge and up-to-date modelling systems opens the possibility for businesses to simulate different climate risk scenarios such as extreme weather events or supply chain disruptions to confidently determine potential losses avoided through resilience measures. In the ASRS era, risks are becoming more complex and frequently unpredictable. This makes them decisively more difficult to respond to. Exercising your response plans is therefore no longer a compliance activity. It serves as a leadership tool to build organisational resilience, test the robustness of decision-making frameworks, and foster trust both within the organisation and among external stakeholders.

What should businesses be doing next? Think long-term!

Understanding your reporting obligations under the ASRS are clearly a necessity, however, the need to act strategically as a business extends far beyond this. This new age of ASRS and climate-risk landscape must be internalised as ‘climate first’ as opposed to ‘climate only’. Taking an intensely proactive and strategic approach is vital to ensure your business is ahead of the curve.

Implementing processes and systems should take place now.

This will undoubtedly help future reporting and performance, especially considering the extended timeframes often required for these to become fully operative. Identifying key people within your business who can pioneer and promote the adoption of climate risk and opportunity into your operations, is vital to building internal accountability.

The bottom line is that a reimagining of insurance is required – it’s power within your business ceases to reside purely within protection but to enable transformational investment and innovation.

Conclusion

The introduction of the ASRS marks a pivotal shift in how businesses must approach climate risk – no longer as a peripheral concern but as a central pillar to their strategic operations. As mandatory disclosures come into effect, companies must move beyond simply ticking the compliance box and embrace this progression as an opportunity to lead in this rapidly developing space.

Climate risk is business risk. But what must be realised is that within that risk lies bountiful potential for innovation, operational efficiency, stakeholder trust, and access to sustainability-aligned capital. Businesses that act early by embedding climate considerations into their operations and proactively manage risk will not only meet regulatory requirements, they will outperform market competitors.

Howden, in partnership with Parvate ESG, is uniquely positioned to help businesses navigate this transition—not just by managing risk, but by enabling investment in a more resilient, sustainable future.

Key takeaways

- ASRS is a strategic imperative, not just a compliance requirement: businesses must embed climate risk into core operations, not just tick compliance boxes.

- Insurance is a catalyst for climate resilience and innovation: it supports investment in low-carbon infrastructure, nature-based solutions, and risk mitigation.

- Early action builds competitive advantage across the value chain: suppliers in Groups 2 and 3 must prepare now to meet the expectations of their Group 1 clients.

- Governance failures have real consequences: Directors face personal liability for governance failures under ASRS.

- Tailored insurance solutions like parametric insurance empower control: businesses can define their own risk thresholds and ensure resilience measures are recognised by the insurance market.