Directors' & Officers' insurance

D&O Liability Insurance

If things go wrong in a business, the senior managers, including directors, officers and partners, are at risk of claims being made against them. Directors’ and Officers’ (D&O) insurance and Management Liability insurance can help protect these individuals against the resulting financial costs, such as fines and legal fees.

What does Directors’ and Officers’ insurance cover?

Directors’ and Officers’ (D&O) Liability insurance gives financial protection in the event you are sued personally. D&O protects you against claims made against you or your co-directors within the scope of your everyday business. It is there to cover you for legal costs as well as any damages. D&O insurance covers directors' acts and the cover should extend to those individuals that are subject to regulatory approvals (such as the Senior Managers regime), the Data Protection Officer, General Counsel, Risk Manager and other senior individuals (including employees in managerial capacities).

What does good D&O insurance look like? What to look out for:

D&O insurance is there to pay for costs relating to mounting a defence, and any damages or settlements relating to the matter. Any allegation made by a third party against a director or officer, no matter how frivolous, needs to be vigorously defended, otherwise, there is a risk of judgement being entered in default of a defence.

- Entity cover for employment practices liability claims

- Official investigations

- Crisis management

- Entity cover for securities claims (for listed companies)

- Retired directors

Other areas that give rise to claims include:

- Positions on outside boards

- Wrongful termination, sexual harassment or discrimination

- Initial public offerings

Directors and officers can be held liable for their own actions and inactions – and the actions of their co-directors. Directors’ personal liability for the performance of a company is unlimited. If the shareholders want to sue for mismanagement, they can, and do, quite frequently.

Read 'Light on the horizon'

Click on the link below to read 'Light on the horizon' and our forecasts for what the D&O market has in store for the rest of 2022.

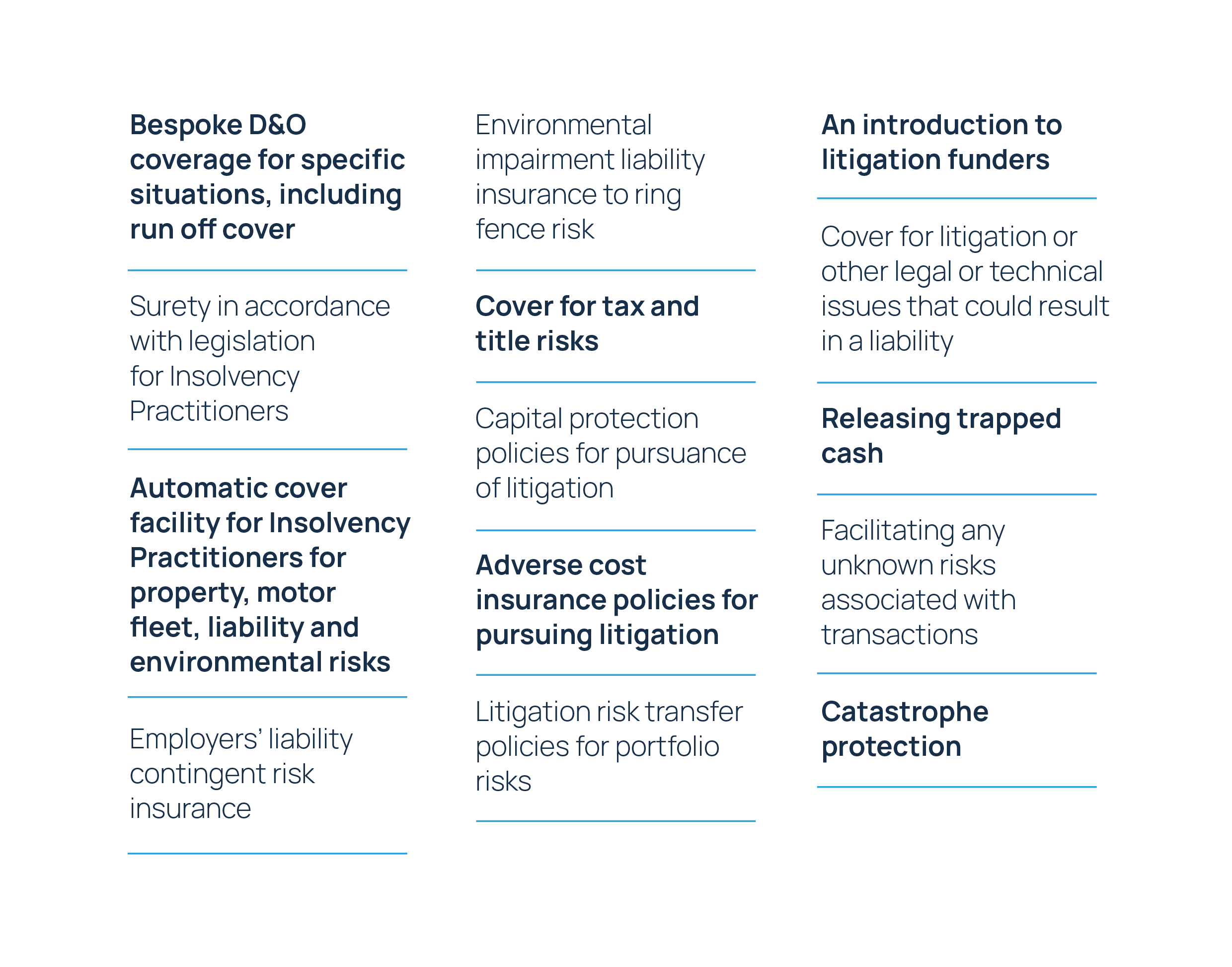

Howden's Special Situations team:

Howden’s Special Situations team is made up of experts across the business who have come together to provide a complete offering to clients needing distressed risk solutions.

We are both sector and product agnostic. We draw on experience from legal, accounting, banking and insurance backgrounds and combine that with our broad market access and traditional product expertise. This allows us to partner a boutique advisory approach with the leverage of a global insurance group, placing over $14.5bn in premium annually.