2022/23 Policy year increases in P&I reinsurance costs

The International Group has announced that the group's pooling structure and reinsurance contract for the 2022 policy year has now been finalised (link). The changes are quite broad and we invite you to read the full text from the International Group via the link above. We draw your attention to the following:

CHANGE IN REINSURANCE RATES

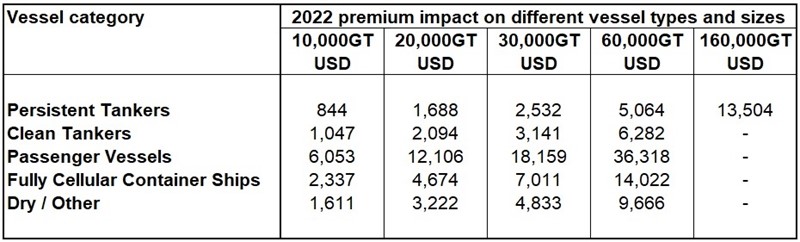

Reinsurance rates have increased and cost is being allocated in accordance with vessel types as below, presented on Estimated Total Call (ETC) basis:

Persistent tankers

Increase in rate from $0.5625/GT to $0.6469/GT. This represents an increase of $0.0844/GT ie +15%.

Clean tankers

Increase in rate from $0.2619/GT to $0.3666/GT. This represents an increase of $0.1047/GT ie +40%.

Passenger vessels

Increase in rate from $3.2624/GT to $3.8677/GT. This represents an increase of $0.6053/GT ie +18.6%.

Fully Cellular Container Ships

Increase in rate from $0.4249/GT to $0.6586/GT. This represents an increase of $0.2337/GT ie +55%.

Dry / Other

Increase in rate from $0.4028/GT to $0.5639/GT. This represents an increase of $0.1611/GT ie +40%.

A sample of increases across different GT bands is below:

CHANGE IN REINSURANCE PROGRAMME STRUCTURE

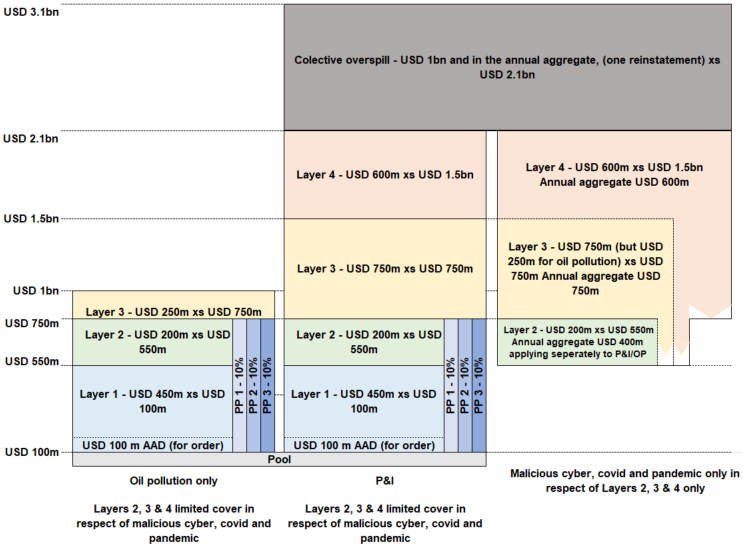

Please see the diagram below prepared by the International Group:

NOTABLE CHANGES TO COVER

Reinsurers have introduced market-wide coverage restrictions in respect of Malicious Cyber, Covid-19 and other new Pandemics. Within the reinsurance arrangements for 2022, the International Group P&I Clubs have secured cover as follows:

- The new Layer 1 has been put in place with no amendment to coverage for the 2022 year, resulting in free and unlimited reinsurance for all losses including those arising from Malicious Cyber, Covid-19 and Pandemic losses up to US$ 550m per vessel.

- Within Layers 2, 3 and 4, free and unlimited cover for all losses, but for those arising from Malicious Cyber, Covid-19 and Pandemics where each layer has an annual aggregate limit in place, totaling US$2.15bn in annual aggregate cover for these risks across these three layers.

International Group clubs have agreed to pool any losses that exceed the annual aggregate limit recoverable from the above reinsurance programme.

Furthermore, we encourage all assureds to be aware that cover afforded for non-mutual cover (for example, contractual liability cover extensions or non-pool fixed premium P&I arrangements) might not mirror cover afforded in respect of Covid, Pandemic and Cyber as described above, where cover exclusions or significantly reduced sub-limits might be in place.

We also encourage assureds to review their P&I exclusions as relates to Cyber cover in respect of War and Terrorism.

For any questions regarding the contents of this Marine Client Advisor or for any other marine insurance enquiries please do get in touch.

Howden Insurance Brokers is not a technical, commercial or legal adviser. Any commentary made in this document should not be construed as such, and we do not guarantee in any way the accuracy of the resources used or referenced in this document. In case of doubt, formal advice should be obtained that is directly relevant to your circumstances.