Is New Zealand’s dairy industry ready to face climate change?

Is New Zealand’s dairy industry ready to face climate change?

Australia is well known around the world for its dairy industry, being the fourth largest rural industry and producing approximately 8,776 million litres of milk each year, of which 29% is exported.

But New Zealand‘s contribution is even higher, thanks to optimal climate conditions, rich soils and abundant water. New Zealand produces approximately 21 billion litres of milk per year, contributing to approximately 3% of the world’s milk production.

Despite these eye watering numbers, the dairy industry isn’t without its challenges. Dairy farmers have experienced economic losses globally due to heat stress, which are caused by increasing environmental temperatures negatively effecting milk quality, production and even the future fertility of livestock.

How can the dairy industry protect itself?

Typically, with insurance being costly, inadequate, and difficult to obtain for some dairies – farmers are at the mercy of the environment.

According to Capgemini’s World Insurance Report (WIR) 2019, “Almost a third of business customers (31%) say disruptive environmental patterns will impact them significantly, versus 23% of individual customers”. This number is likely to have increased in the last few years.

An alternative solution, Parametrics, can offer a very specific, targeted outcome for a traditionally costly and hard to place risk.

What is Parametrics?

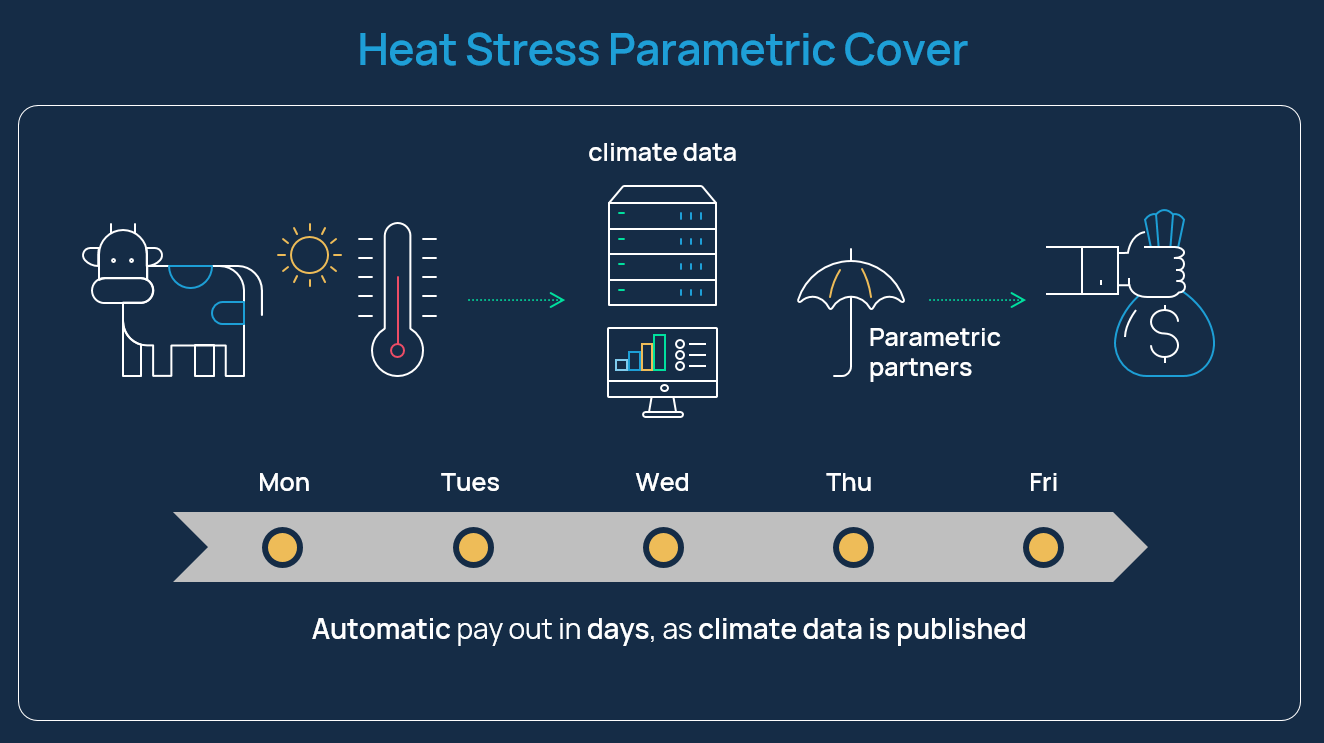

Parametrics is an innovative solution that allows you to obtain cover for a specific set of events or circumstances – and if they do – provides a fast, automatic pay-out, no questions asked.

It involves the use of technology and data to identify the protection that you may need, measure the risk and source the relevant accompanying data. At the time of an incident, it removes the administration of working out your loss, and going through the hassle of lodging a claim.

For example: Following higher than average temperatures for the month of February, milk yield has declined. Livestock are showing signs of heat stress (aggression, malaise), quality has declined and this has the potential to cause reputational damage to both farmer and brand.

With traditional Insurance – evidence of a loss needs to be established and proven.

Not with Parametrics – as soon as temperatures exceed a pre-determined level, an automatic pay out is issued, that’s it!

It’s insurance - but not as you know it

Parametrics work using a combination of analytics, a dedicated risk transfer vehicle, and is backed by well-established and financially sound insurers and/or reinsurers.

There is no need to lodge a claim, gather information or do anything at all. Your pay out is issued as soon as the parameters are met. It offers peace of mind in the most challenging circumstances.

Based in technology

Parametrics uses state of the art data indexing technology to assess, structure and price your risk in an easy to understand format using up to the minute data and analytics from both here and around the world, in real-time.

“Howden works with several leading Parametric providers, so depending on the risk or the peril we will partner with the right provider to cover your risk,” said Craig Harms, Howden's Parametric specialist.

"The most common perils covered by Parametrics are weather and climate related, including natural disasters. Typically, Parametrics are used for the agriculture, renewable energy, construction and supply chain industries, but we are not just limited by these.”

Parametrics are on the increase

Parametric policies are on the rise with proven success covering perils involving rainfall, wind, snow, drought, humidity, solar radiation, earthquakes, volcanoes - any scenario could be considered. It covers both physical and non-physical damage, increasing operational costs, reduction in revenue and other intangible losses.

According to WIR 2019, 35% of business customers are highly interested in parametric insurance, versus 16% of individual customers.**

While 55% of insurers have implemented technologies such as machine learning, artificial intelligence, and advanced analytics to help accurately quantify risk, they trail in some critical risk-quantification capabilities with less than 30% of insurers focused on it.**

Coupled with expanding agricultural markets globally, premiums have continued to rise year on year with developing markets experiencing an average of 20% increases vs 5% increases in developed markets. Parametrics are fast becoming a vital solution.

Closing

Howden partners with leading organisations who specialise in Index-based Parametric insurance that cater to exact situations like these. The scope of what they do, and can do, is endless and just one of the many services available to our clients.

We’d love to chat with you about how we can help you manage your climate risk.

*Figures sourced from Dairy Companies Association of New Zealand (Dcanz) and Dairy Australia ‘In Focus2020’ – The Australian Dairy Industry.

**Figures sourced from BirdsEyeView – Weather-Risk – The Future for Howden Broker Partnerships 2021.

We are here to help

If you would like to discuss further insurance solutions for your business, please contact Elmar Nel at [email protected].