Why ESG is important when renewing your D&O insurance

Is it time for companies to get on the front foot in regards to Environmental, Social and Governance (ESG)?

In what is an already extremely challenging D&O market for Australian insureds, heightened underwriting focus by insurers is now being applied to the management of Environmental, Society and Governance (ESG) related risks. This heightened focus reflects the need by insurers as part of their underwriting process to assess a company’s potential risk profile connected to ESG issues from both:

- A direct sense in terms of potential exposure to claims involving matters such as climate change, waste reduction, workplace health and safety, bullying and harassment, diversity and inclusion and executive compensation; and

- An indirect sense in terms of how the management of these issues reflects a company’s broader stance on corporate governance, risk management and decision making generally.

Changing attitudes

Up until recently, there was a tendency to rely on financial performance metrics in determining adherence to directors’ duties and obligations under the Corporations Act 2001 (Cth) and this flowed through to the D&O underwriting process.

Given changing attitudes of investors, financiers, consumers and regulators in this regard however the landscape has shifted significantly in recent years. D&O insurers are reflecting this shift in their underwriting approach as they view sub-standard performance in relation to ESG as a potential indicator of reputational, financial and litigation risks.

In short, D&O insurers are now examining the balance an insured is seeking to achieve between financial performance and shareholder returns with social responsibility.

ESG scoring and reporting has the potential to unlock a significant amount of information on the management and resilience of companies when pursuing long-term value creation.

Boffo, R., and R. Patalano (2020), “ESG Investing: Practices, Progress and Challenges”, OECD Paris

ASX Corporate Governance Principles and Recommendations

In its Corporate Governance Principles and Recommendations 4th Edition (February 2019) (the Principles and Recommendations), the ASX Corporate Governance Council (ASX CGC) set out recommended practices that “…are likely to achieve good governance outcomes and meet the reasonable expectations of most investors in most situations.”

From a disclosure risk perspective, each ASX listed entity is required under the relevant listing rules to disclose in its annual report the extent to which it has followed the Principles and Recommendations. This includes at Recommendation 7.4 disclosing whether a listed entity has any material exposure to environmental or social risks and, if it does, how it manages or intends to manage those risks.

How an entity manages environmental and social risks can affect its ability to create long-term value for security holders.

ASX Corporate Governance Principles and Recommendations 4th Edition (Feb 2019)

ESG and D&O Insurance

As ESG issues have taken on greater prominence in recent times, D&O insurers have mirrored this trend by requiring greater detail on this topic from insureds as part of their underwriting assessment. This ESG information is then assessed by insurers from both a risk acceptance perspective in the first instance as well as the terms and conditions which might ultimately apply to a policy.

Advocacy of an insureds ESG framework should therefore form an important part of the written renewal information provided to insurers. For those insureds who undertake face-to-face renewal presentations with their insurers, you can also expect heightened questioning from insurers as part of these presentations.

New ESG focused D&O capacity

From an underwriting perspective, the change in insurance market attitude to ESG risks is reflected in recent news of the establishment of Lloyd’s Syndicate 4321. This new Lloyd’s syndicate will offer additional D&O capacity (amongst other classes of insurance) for eligible clients that can meet the standards of its ESG rating criteria. This new syndicate will be managed by leading Lloyd’s D&O syndicate Beazley.

Evidence demonstrates that businesses with high ESG ratings are likely to have a lower risk profile, and we are looking forward to building long-term partnerships with clients that, like us, value doing the right thing.

Will Roscoe, head of Alternative Portfolio Underwriting at Beazley

Howden strongly recommend that insureds get on the front foot in advocating to insurers how they manage their ESG commitments as part of their D&O insurance policy renewal process.

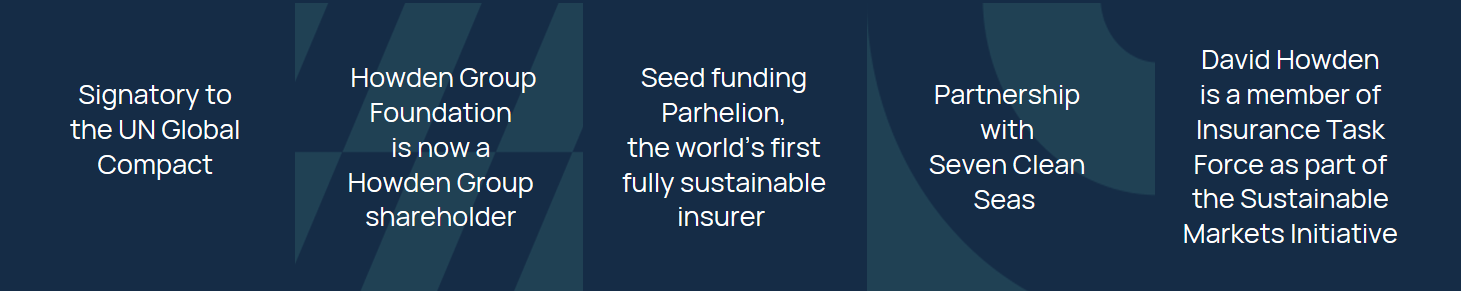

Howden & ESG