Singapore and Malaysia insurance market growth appetite for 2024

Published

Read time

In Howden Markets Asia’s latest proprietary study conducted across more than 50 insurers in the Singapore and Malaysia insurance markets, we unveil pivotal insights into the markets appetite in 2024, presenting a compelling narrative of growth amidst evolving challenges.

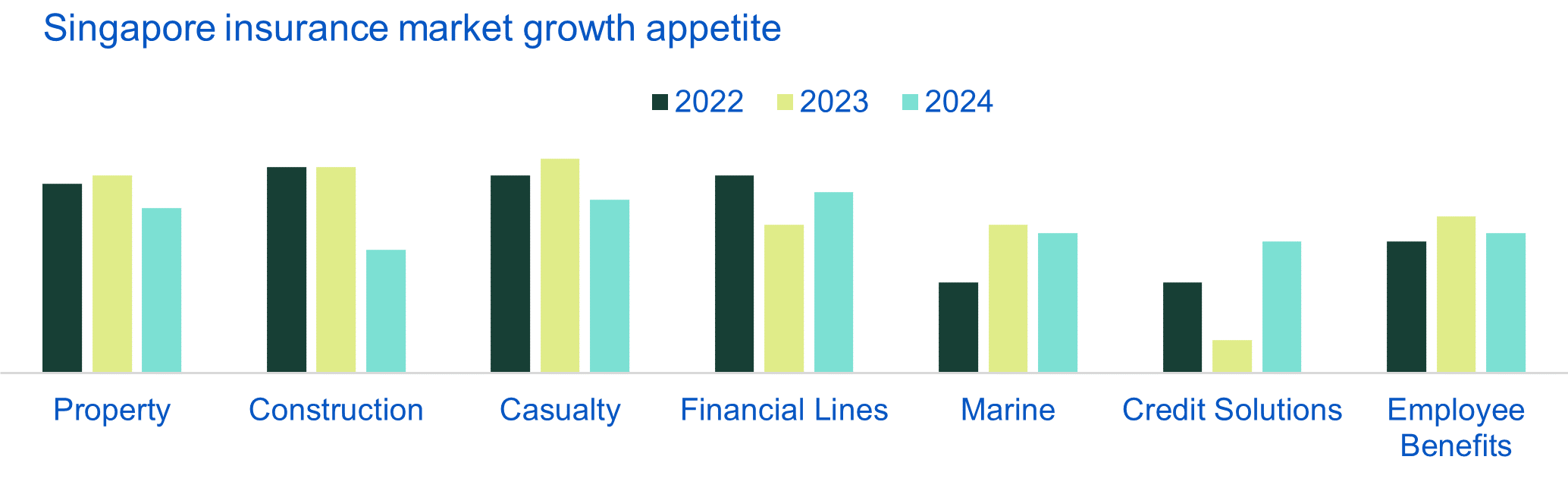

Singapore

Singapore's market is witnessing a surge in demand for comprehensive non-life insurance coverages, including property, casualty, and specialty insurances. This demand is propelled by businesses' increasing recognition of the need to mitigate operational risks in today's volatile global environment. Insurance companies are responding with innovation, leveraging advanced analytics and technology to tailor competitively priced, relevant products. Additionally, Singapore's strategic position as an insurance/reinsurance hub in Asia underscores its potential for regional expansion.

The escalating medical inflation, however, is a concern, driving premiums up for corporate employee benefits. Insurers are innovating by diversifying benefit packages with a focus on comprehensive health and wellness programs, integrating technology, and preventive care to manage costs effectively.

Yet, the market is not without its challenges. Macroeconomic uncertainties, geopolitical tensions, regulatory changes, and the rapid pace of digital transformation introduce new risks, including cyber threats, necessitating ongoing product adaptation.

Malaysia

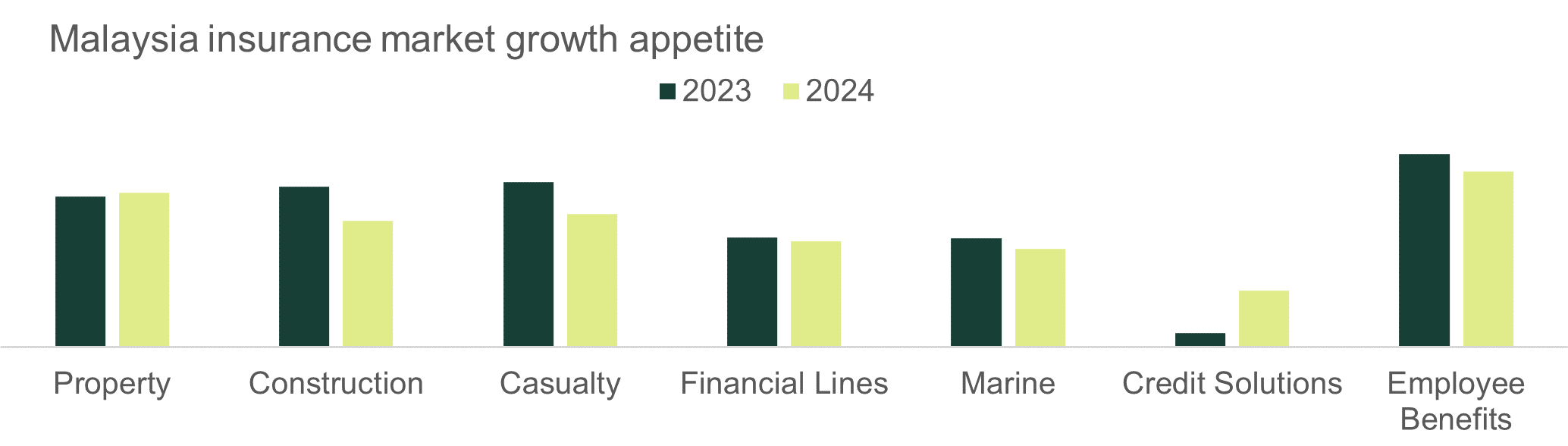

In Malaysia, the non-life insurance market is poised for growth, driven by expanding industries such as technology, manufacturing, and renewable energy. The government's supportive policies towards digitalisation and sustainable development further bolster this potential.

Both the Singapore and Malaysia markets show a dynamic shift in insurers' focus, with a heightened appetite for Cyber, Marine, Cargo, and Property insurances in 2024. This strategic pivot reflects the industry's agility in responding to the evolving needs of clients.

Our study reveals that success in these vibrant markets hinges on insurers' ability to navigate macroeconomic uncertainties, innovate in response to client demands, and manage emerging risks effectively. As we look ahead, the insurance industry in Singapore and Malaysia is set to navigate a landscape brimming with opportunities, underscored by the need for strategic agility and innovation.