Engineering Insurance

There are three main parts of coverage in constructor all risks insurance. The first covers damage to property, such as damage to buildings and other structures being constructed or to the existing building in which the construction is being carried out. The second aim to cover plants and equipment of contractor using in construction project. And third part covers liability for third party claims for injury and death or damage to third party property. The basic principle is that contractors' all risks insurance covers those external physical losses and majority excluded such as defects due to 'wear and tear, obsolescence, deterioration, rust and mildew, loss and damage arising out of war and for faulty workmanship and faulty design'. The benefit to the insured under this type of policy is that the burden is shifted to the insurer who, to resist the claim, is required to show that the cause of the loss falls within an exclusion. This policy is usually taken out in the joint names of the principal, main contractor and subcontractor. Other The consequence of joint names insurance is that each party has its own rights under the policy and can therefore claim against the insurer. Each insured should comply with the duties of disclosure and notification. Example of construction projects that can be insured under Contractor’s All Risks Policy are; Road, Railway, Airports, Tunnels, Bridges, etc… Building (Residence, Office, Commercial Building, Factory, Mall, Stadium) Civil Works (Power Plants, dams) Silos, Towers, Chimneys Etc…

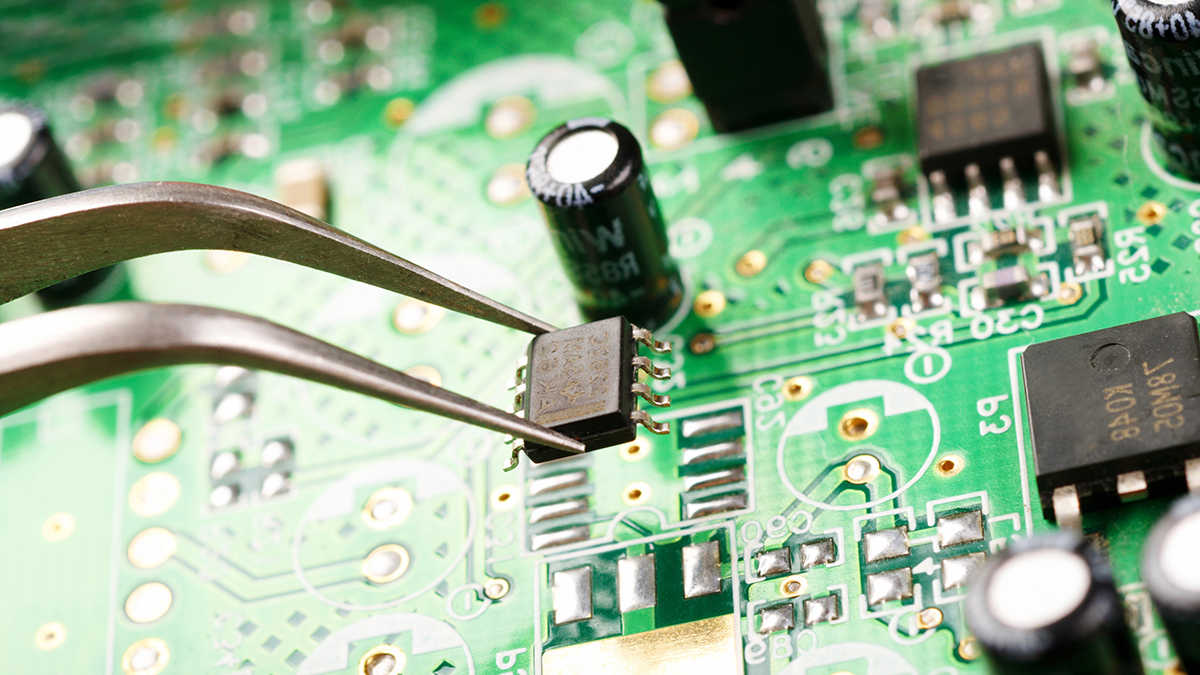

In some projects which there work is majority on erection or installation key machinery separate from civil work. EAR policies are designed to cover the risk of loss arising out of the erection and installation of machinery, plant and steel structures, including physical damage to the contract works, equipment and machinery, and liability for third-party bodily injury or property damage arising out of these operations. Coverage for delay and start-up (DSU) costs is typically an optional coverage. Covered parties include the principal, main contractor, subcontractors, and in some cases suppliers and manufacturers of equipment. Examples of the types of projects for which EAR coverage is typically purchased include power plants, manufacturing and fabrication facilities, water and wastewater treatment facilities, and telecommunications centers (particularly where the erection of signal towers is involved). Some insurers combine erection all risks and contractors all risks coverage into one form. Although these terms are sometimes used interchangeably, there are some substantive differences. The Erection All Risks insurance is designed to cover involved erection, installation, testing and commissioning of electrical or mechanical equipment. The Erection All Risks insurance provides coverage against : Material damage to work under erection. Damage and loss to contractor's plant & equipment using in project. Damage to Third party property and/or bodily injury arising in connection with the erection work.

Due to general property insurance (all risks policy) designed to cover external physical loss to property included machinery (if any) and internal Machinery Breakdown is clearly specific excluded cause of damage from the policy. Machinery Breakdown Insurance Policy is designed specific for all types of machinery, plant, mechanical equipment and apparatus like Power generating units (boilers, turbines, generators), power distribution plants (transformers, high & low tensions equipment) as well as production machinery and auxiliary equipment (machine tools, weaving looms, paper machines, kneaders, pumps, compressors, pipes, tubes, etc) can be covered under this policy. The policy serves covers unforeseen and sudden physical losses or damages to the insured items necessitating their repair and/ or replacement on example loss from defects in casting and materials, faults are discovered after the manufacturer's guarantee, Faulty operation, failure of safety systems, lubrication systems, control systems, lack of skill, negligence are also insured, losses occurring due to short circuits, excess voltage, defective insulations, corona discharge and mechanical stress are also insured, overheating of the tubing resultant in destruction of entire piping system, besides production and operational faults, the policy also covers damage due to the human element. Basis of Compensation Basis of settlement can be divided as two scenario like Partial Loss and Total Loss Basis. In case of Partial Loss, the insurance indemnify on cost of materials under replacement cost basis might included wages incurred for the purpose of repairs plus a reasonable percentage that covers the overhead charges. If the cost of repairs is equal or exceeds the actual value of the machinery insured, then the settlement is made on a Total Loss Basis. The settlement under Total Loss Basis is indemnify as he actual value is calculated by deducting proper depreciation. Exclusions The individual exclusions from the cover are listed in the machinery breakdown policy and mainly comprise loss or damage caused by Fire, lightning, chemical explosion, burglary and theft. Inundation, flood, earthquake, subsidence, landslide, impact of land-borne, water-borne or airborne craft. Wear and tear owing to ordinary use or operation as well as erosion, corrosion, etc. War or warlike situations, civil commotion, strikes, etc. Willful acts or gross negligence. Faults or defects existing at the time of commencement of policy. Losses covered by the manufacturer's warranty. Nuclear radiation or reaction.

This insurance policy will only be considered as protection on consequences financial loss after insured are suffering from property damage under Construction all risks or Erection all risks policy. Advance loss of profits cover provides indemnity to the insured in respect of lost profits due to the contract works being delayed as a result of a loss insured under the terms of the works section of a (Contractors all risks or Erection all risks) policy. The following basic considerations must always be kept in mind when considering an Advance loss of profits risk: Generally, it is only the principal and financiers who can be insured. The ALOP sum insured must be reflected in reasonable proportion to financial loss during project delay. The entrepreneur's risk as well as contractual penalties cannot be insured under an Advance loss of profits policy. As the period of indemnity starts with the provisional hand over date at the end of the erection/construction period (date of practical completion) and not the date of any loss like the material damage policy, it is important that the erection/construction programme be available for assessment. Extra caution is necessary with experimental type projects and uncertain market conditions. Proved of technical and accounting know-how must be available for loss minimization.

This insurance policy is providing the coverage for Pressure Vessel Plants like Boiler, Compressor, etc… which have tendency for self explosion, erupts or collapse that make damage to plants itself or surrounding property included legally liable to third parties. The standard policy schedule is divided as three sections as option for buying as follows; 1. Damage to boiler or pressure vessel and to other properties insured (caused by explosion or collapse) 2. Damage to surrounding property located adjacent of boiler or pressure vessel 3. Liability to third party who are suffering from explosion or collapse whether it damage to property or bodily injury or death

Contactors Plant & Machinery policy provides coverage for the insured plant and machinery like cranes, excavators, Loaders, Piling Equipment, etc… against sudden and unforeseen accidental and external nature perils by any cause not specifically excluded. The policy can be given only after the successful commissioning of the machinery and applies to the insured items whether they are at work or at rest or being dismantled for cleaning and overhauling. Sum Insured Sum Insured of each item shall be reflected the present replacement cost. Sum insured may include others cost like freight, cost of erection and custom duty, if any. Main Exclusions Electrical or mechanical breakdown Wear and tear, inherent vice, rust, corrosion Willful act or willful negligence Loss/damage for under supplier/ manufacturer warranty Consequential loss Contractual liability

This Electronic Equipment Insurance Policy is consider as one kind of all risks insurance policy by cover any cause but having specific exclusion in the policy of loss of or damage to computer, complicated electronic machinery, air conditioning plants, PDA, or its accessories whilst at work, at rest, being dismantled, moved, re-erected for the purpose of cleaning, inspection, repair or installation in another position. There have three section in policy for options to buy as following; Section 1 : Covers any unforeseen and sudden physical loss or damage to Electronic Equipment's itself from any cause, other than policy excluded. Section 2 : Covers External Data Media and the expenses for reconstruction and re-recording of information. Section 3 : Covers Increased Cost of Working Main Exclusions War & Nuclear Risks Willful Act / Negligence Partial / Total cessation of Work Normal wear & tear Gradual deterioration due to atmospheric conditions Loss or damage due to faulty design Contractual liabilities Consequential Losses Cost of replacement / repair or rectification of defective material and/or workmanship